Market Developments

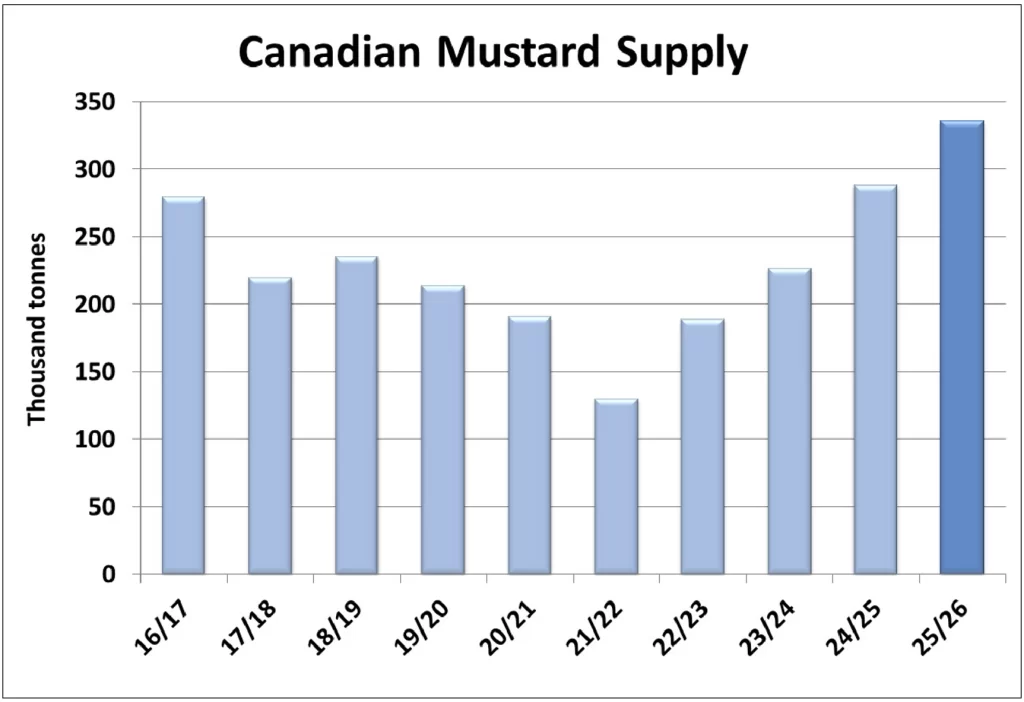

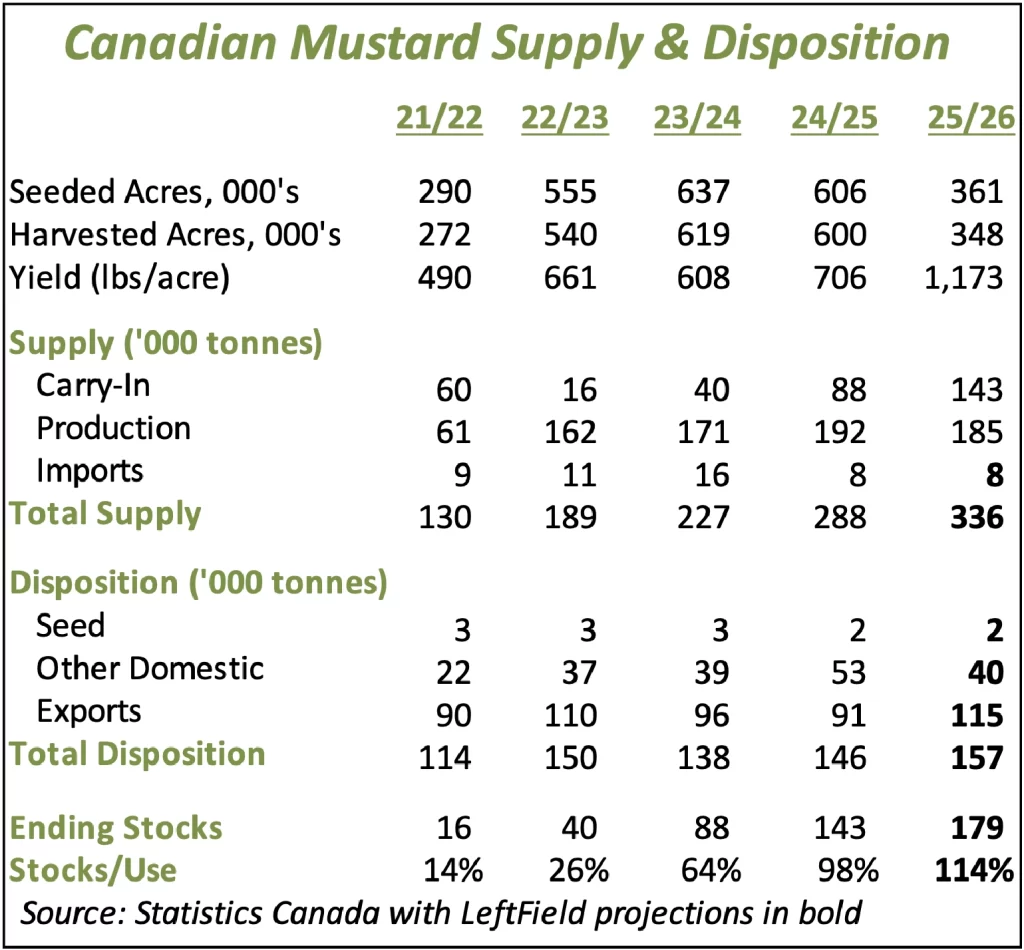

- Earlier this month, Sask Ag bumped up its 2025 mustard yield estimate a bit further to 1,192 pounds (23.8 bushels) per acre versus 1,141 previously and far above StatsCan at 824 lb/acre. Keep in mind, this would be a record mustard yield for the province and it’s likely overstated. If we plug in this latest Sask Ag yield and a similar increase for Alberta acreage, the 2025/26 Canadian mustard crop would come in at 185,000 tonnes, only 4% less than last year despite a 40% drop in seeded area.

- If the 2025 Canadian mustard crop ends up at 185,000 tonnes, close to last year, 2025/26 supplies would be 335,000 tonnes, due to the sharp increase in the old-crop carryover. That said, the 2024/25 mustard crop was reported to be lower quality, with 13% a 3Can or lower, which works out to 25,000 tonnes. This means the “usable” portion of StatsCan’s old-crop carryover of 143,000 tonnes should be reduced by that amount. Regardless, 115-120,000 tonnes of decent quality mustard carried over into 2025/26 isn’t a small amount. Even with this adjustment, 2025/26 mustard supplies would work out to 310,000 tonnes, still the most since 2005/06.

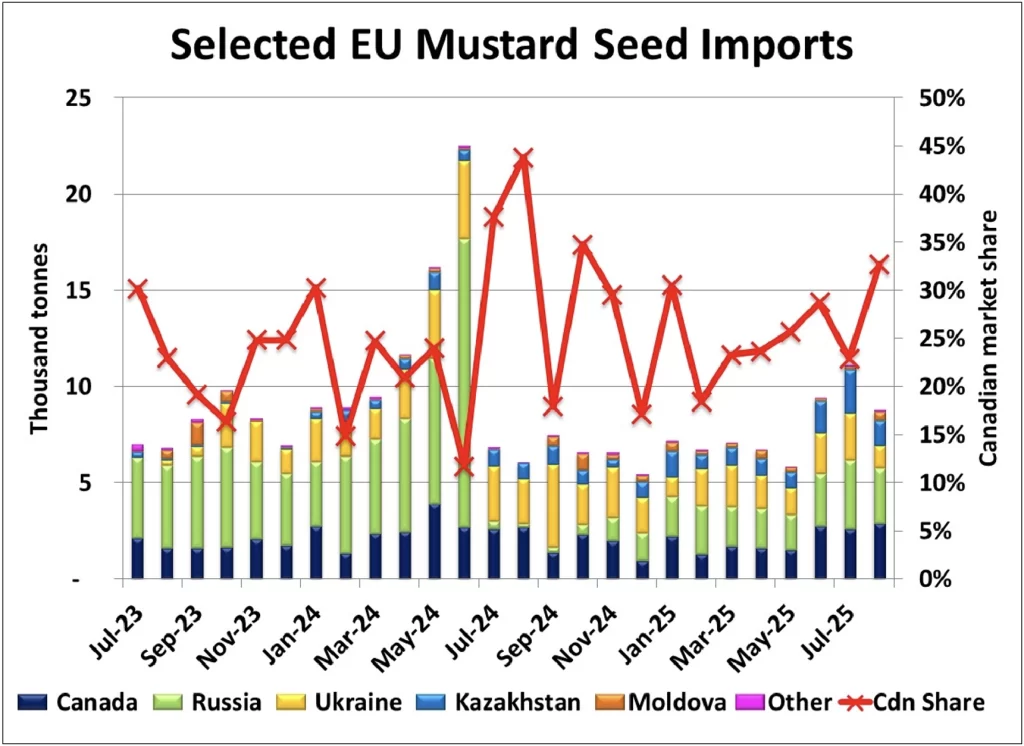

- Mustard imports by the EU slipped to 8,700 tonnes in August, although the last three months look a bit better than previous months. Imports of mustard from Canada and Russia were nearly the same in August at just under 2,900 tonnes each. The Canadian share of 33% was the best since October 2024 while Russian mustard is severely discounted, more than offsetting the 50% EU import tariffs. For August, the trade data indicates Canadian mustard was priced at US$841 per tonne while Russian mustard was only US$335 a tonne. While we don’t have an estimate of Russian mustard production in 2025, it’s possible the lower prices caused by the EU’s tariffs may have discouraged some acreage this spring.

- Through the first quarter of 2025/26, mustard exports by Ukraine are trailing last year’s rapid pace but are still ahead of prior years’ totals, with western Europe as the main destination. We don’t have a solid estimate of 2025 Ukrainian mustard production, making it hard to gauge this year’s export potential. A quieter start in 2025/26 doesn’t necessarily mean lower full-year prospects.

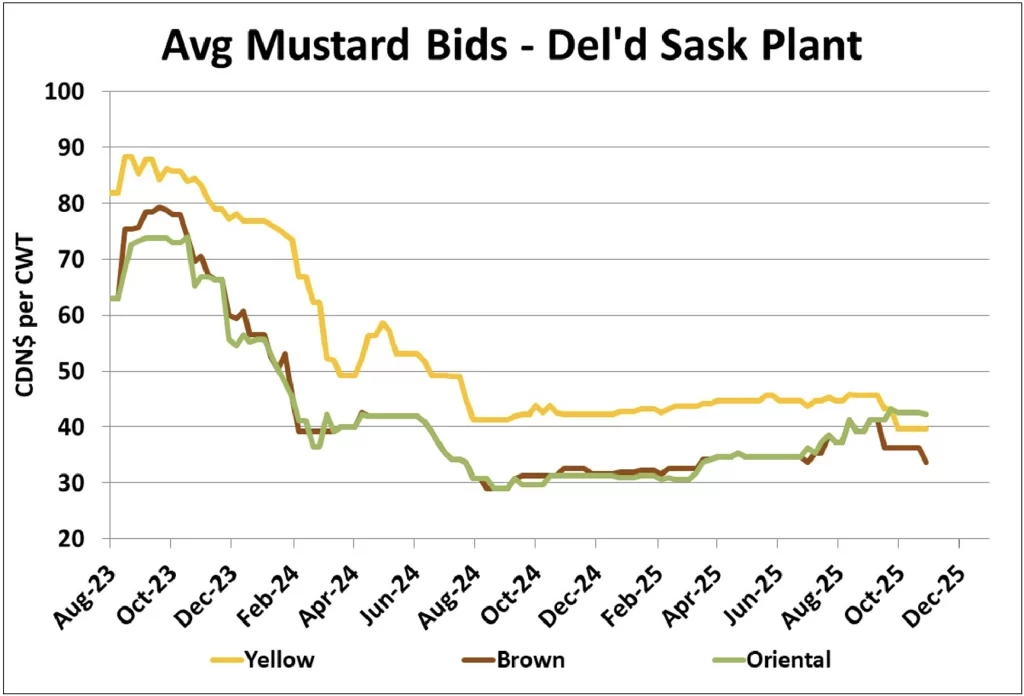

- Since the spring, prices for the three mustard classes have performed very differently. Yellow mustard bids haven’t moved more than two cents through the summer and haven’t shown any response following harvest either. Bids for both brown and oriental mustard tracked steadily higher from April to mid August but at that point, brown mustard bids dropped and are still edging lower. Meanwhile, oriental mustard bids firmed up a bit more in September but then turned sideways in recent weeks.

Outlook

Now that mustard crops are in the bin, markets are becoming quieter. Farmers have stopped selling, but most buyers’ needs are covered, resulting in mostly sideways price direction. There are some differences in the price behaviour of each mustard class. The yellow market is the most stable and is expected to remain in a sideways channel. Brown mustard is suffering from more competition in the European market, which may not improve until later in 2025/26. Oriental mustard is benefiting from a pickup in demand but even that strength has faded. Reluctant farmer selling will limit downside risk for all three.