Market Developments

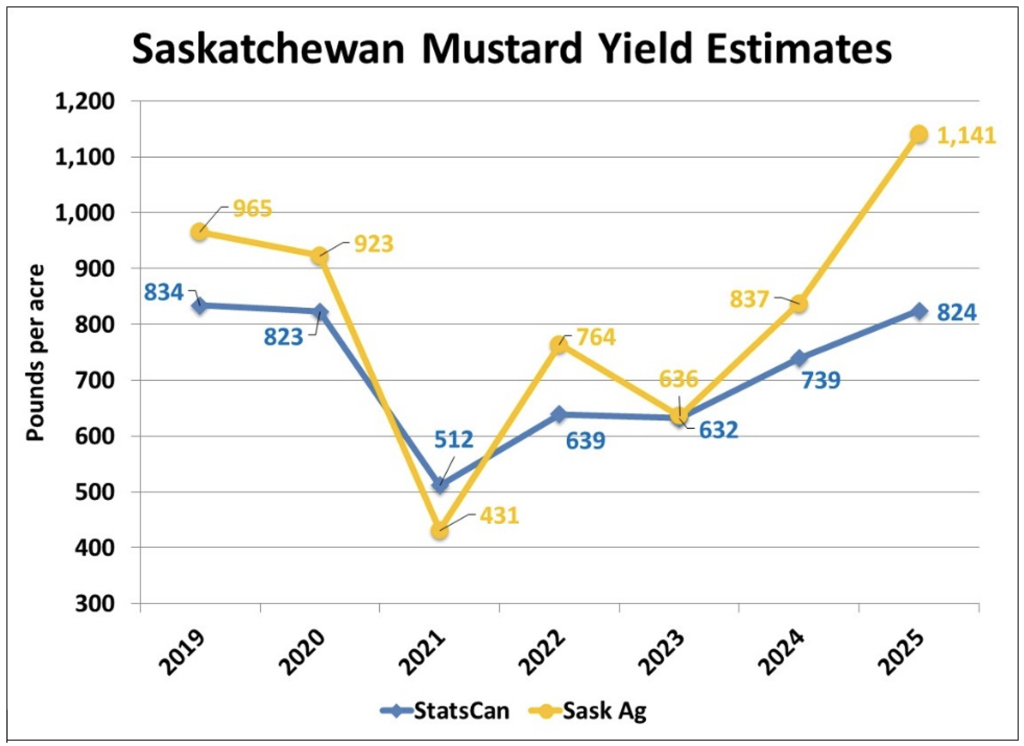

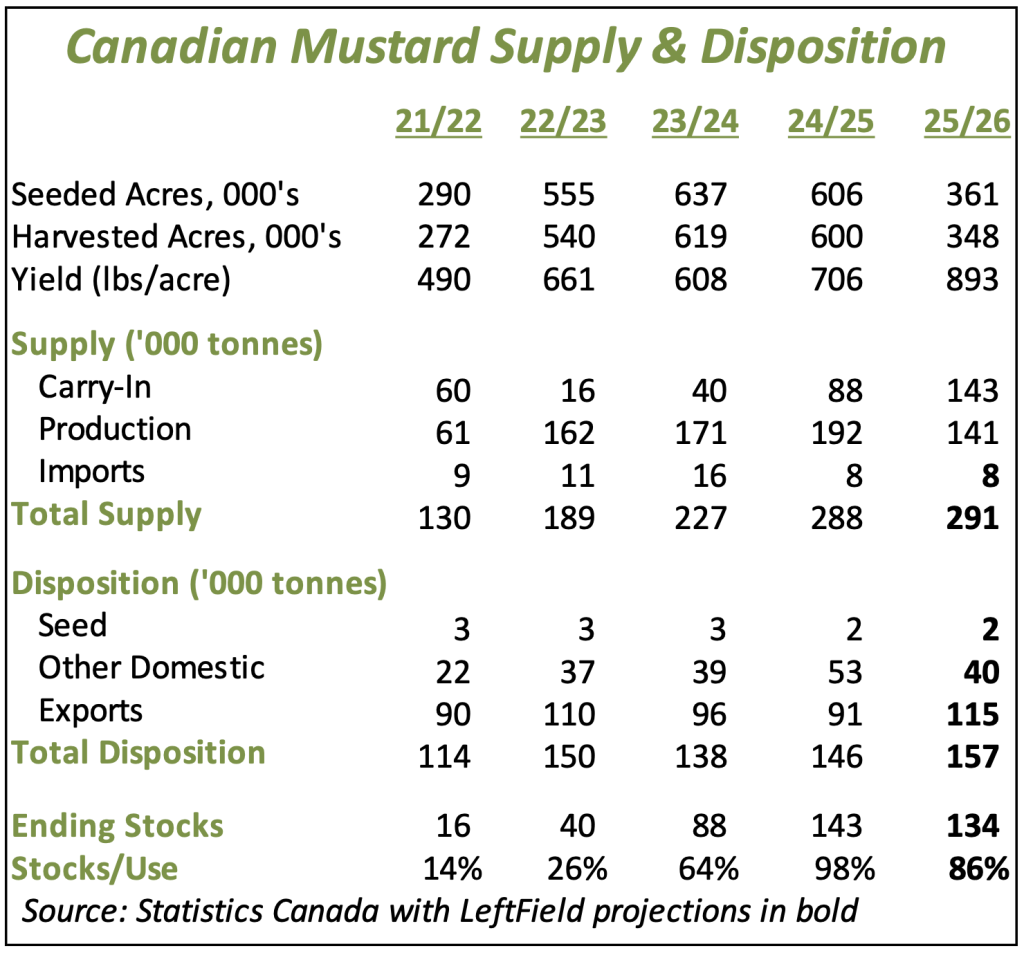

- The 2025 Canadian mustard crop will be smaller than last year, although the size of the drop is still open to debate. The large difference between the StatsCan yield of 893 lb/acre and Sask Ag at 1,141 lb/acre results in crop estimates nearly 40,000 tonnes apart. Even with the lower StatsCan crop estimate of 141,000 tonnes, supplies in 2025/26 would still end up nearly unchanged from last year, due to the much larger carryover from 2024/25. That said, farmers’ target prices for mustard will essentially determine the amount of “working supplies” of the crop.

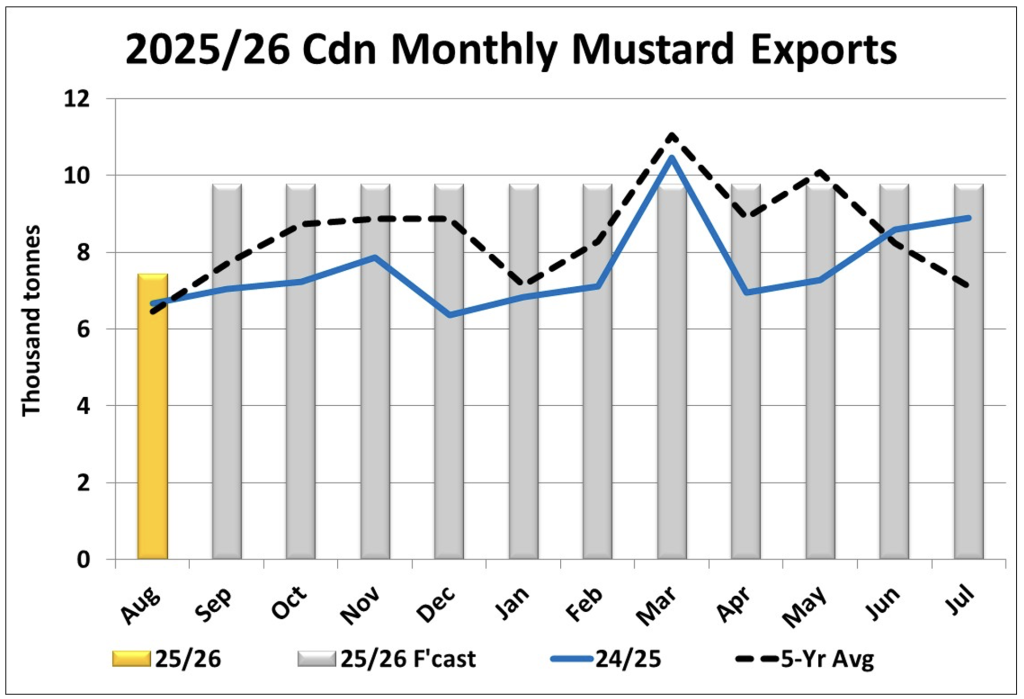

- Mustard exports typically start the year on a slower note and that’s the case again in 2025/26. That said, the 7,400 tonnes exported in August were a bit above average and the best start since 2021/22. As usual, the US and Belgium were the top two destinations. Our full-year export target is fairly aggressive/optimistic at 115,000 tonnes, well above last year at 91,000 tonnes and slightly higher than the 5-year average of 105,000 tonnes.

- The Saskatchewan mustard harvest has been advancing more rapidly in recent weeks and is now much closer to the average pace (and completion). As of September 29, 79% of the crop had been harvested versus the 10-year average of 91% complete. Favourable weather since the Sask Ag report should have allowed solid gains by now. So far, we haven’t received any feedback of meaningful quality issues with the 2025 mustard crop.

- The USDA won’t release yield estimates for the 2025 mustard crop until January, but we’ve seen better-than-expected yields for other crops in Montana, which suggests an average mustard yield is possible in 2025. If we plug in an average yield of 585 lb/acre against FSA seeded area of 123,000 acres (NASS at 165,000 acres), the 2025 crop would come in at 66.1 mln pounds or 30,000 tonnes, 35% less than last year. This return to more normal production levels should also mean a rebound in US mustard seed imports, which could top 60,000 tonnes in 2025/26 versus 54,400 tonnes in 2024/25 and provide some support for the yellow mustard market.

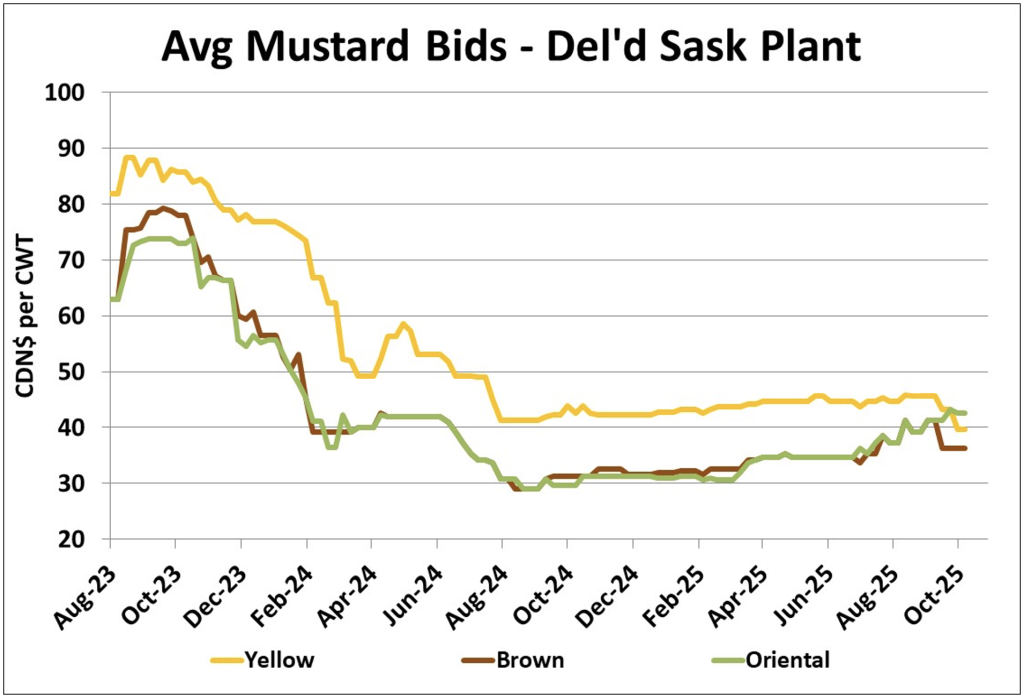

- In the last week or two, mustard bids have stabilized after prices for the various classes moved in different directions. Brown mustard bids have been softer and developed a sizable discount to the other classes while oriental bids have strengthened and yellow mustard continues to run mostly sideways. Those differing moves could be partly related to changes in 2025 seeded area, which raises questions about StatsCan’s acreage breakdown by type.

Outlook

Despite the questions about the quality of mustard supplies, the market is still well supplied. On the surface, this should limit the seasonal upside potential, but the pace of farmer selling will also be a major factor. The brown mustard outlook in the EU is clouded by the availability of mustard from the Black Sea region and Canadian prices will need to remain competitive. Increased exports to the US could add a bit more support for yellow mustard but supplies still won’t be tight, keeping a lid on upside potential.