Market Developments

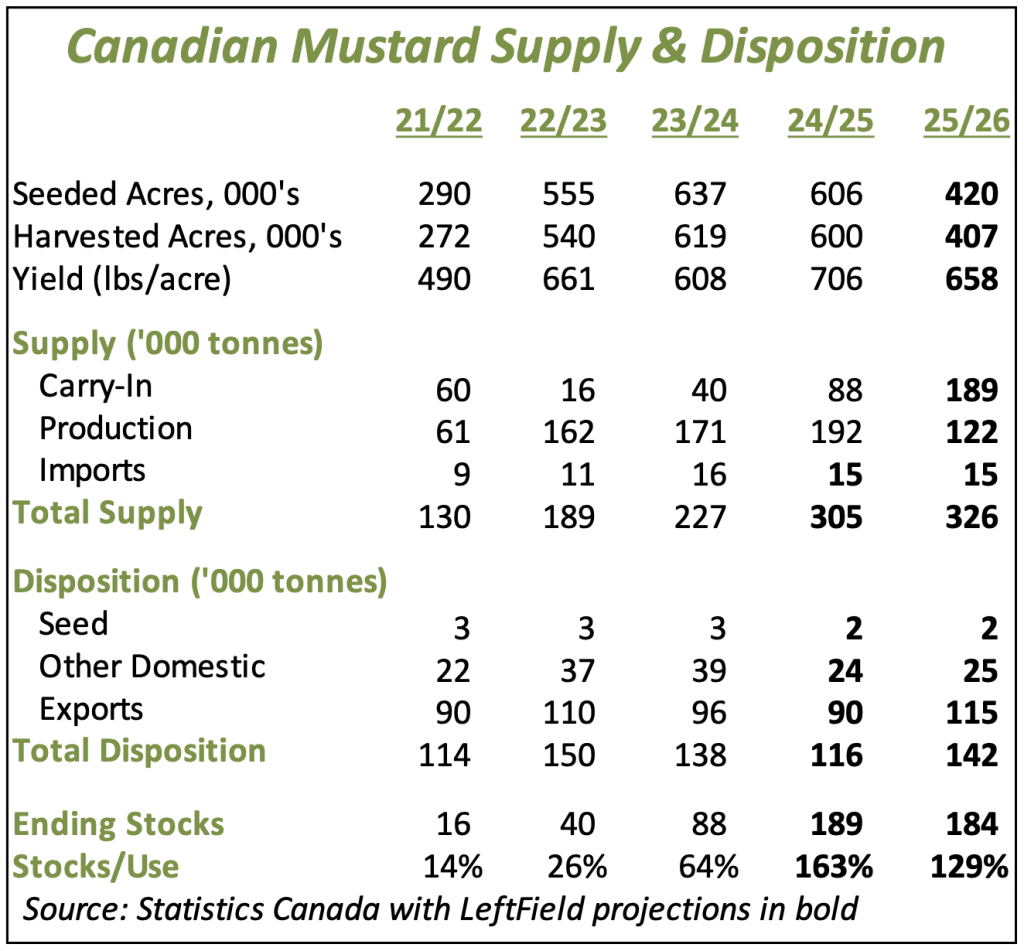

- For the first time all year, Canadian mustard exports have shown signs of life, with 10,500 tonnes in March, in line with a year ago and the 5-year average. Exports to the US rose to 6,500 tonnes, the highest since March 2023 but no other single destination really stood out, including Europe. Even with this stronger month, the year-to-date pace of 59,500 tonnes still trails last year at 62,200 tonnes and is well behind the 5-year average of 69,800 tonnes. For now, we’re remaining cautious with our full-year export forecast of 90,000 tonnes but there is a bit of room to bump that up.

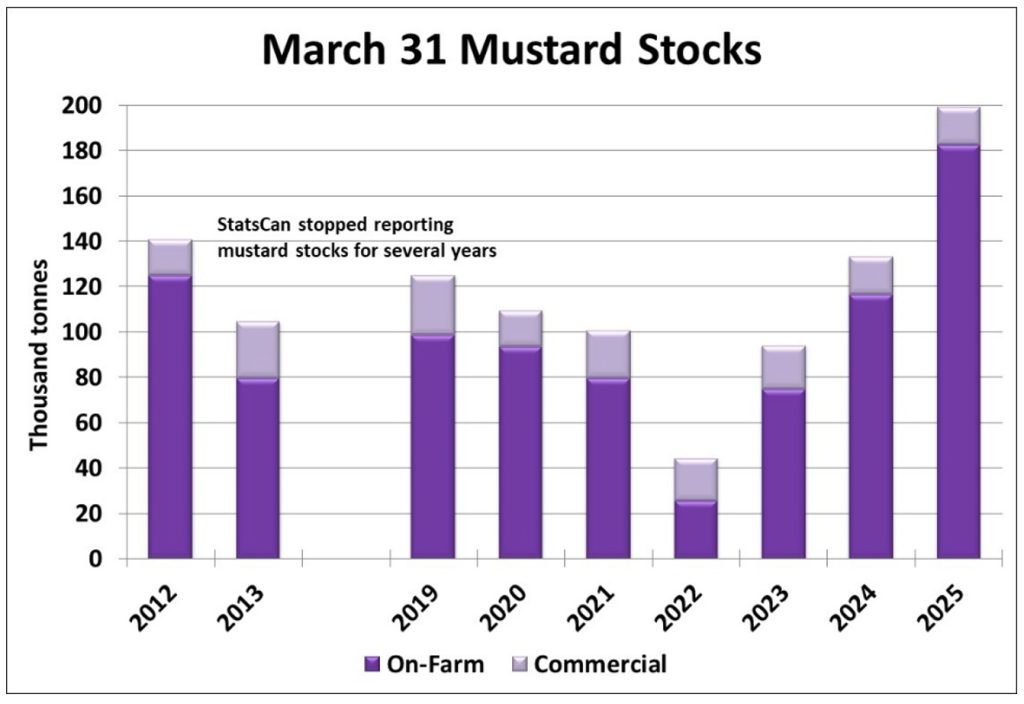

- According to StatsCan, mustard inventories as of March 31 were 199,000 tonnes, 49% more than last year and the largest total since 2006. While there may be some statistical “wiggle room” in this total, it fits with our own ideas of heavy supplies, with the large carryover keeping next year’s supplies large.

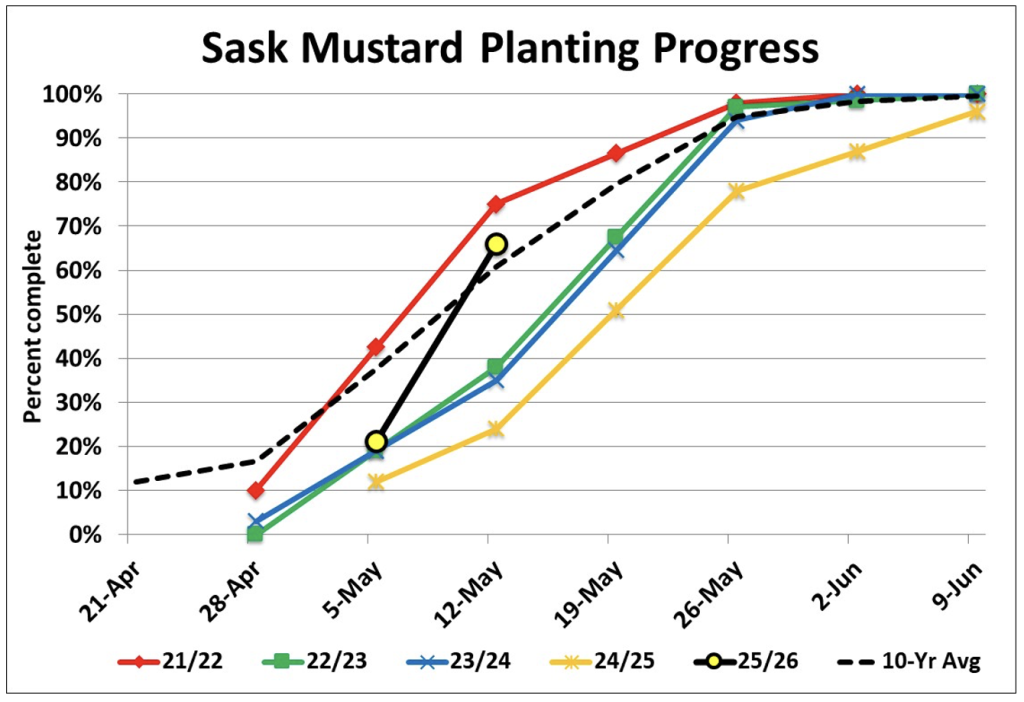

- Planting the 2025 Saskatchewan mustard crop is progressing rapidly, with 66% in the ground as of May 12, a sharp improvement from the 21% the previous week. This is well ahead of the last three years and above the 10-year average of 61% complete. The Alberta crop report also shows a strong start for 2025, with 48% of mustard planted by May 6. Since then, favourable conditions in both provinces have allowed rapid progress, with no serious concerns about the state of the mustard crop yet.

- Mustard growers in the southern prairies are hoping the precipitation forecasts for the next few days come to pass. Dryness hasn’t been critical yet, but conditions have worsened in the last few weeks and crops need moisture soon. By now, the majority of mustard acres are in the ground and need some rain to get off to a good start. That same situation applies to mustard acres in the US, where it’s been even drier, with widespread rains now in the forecast.

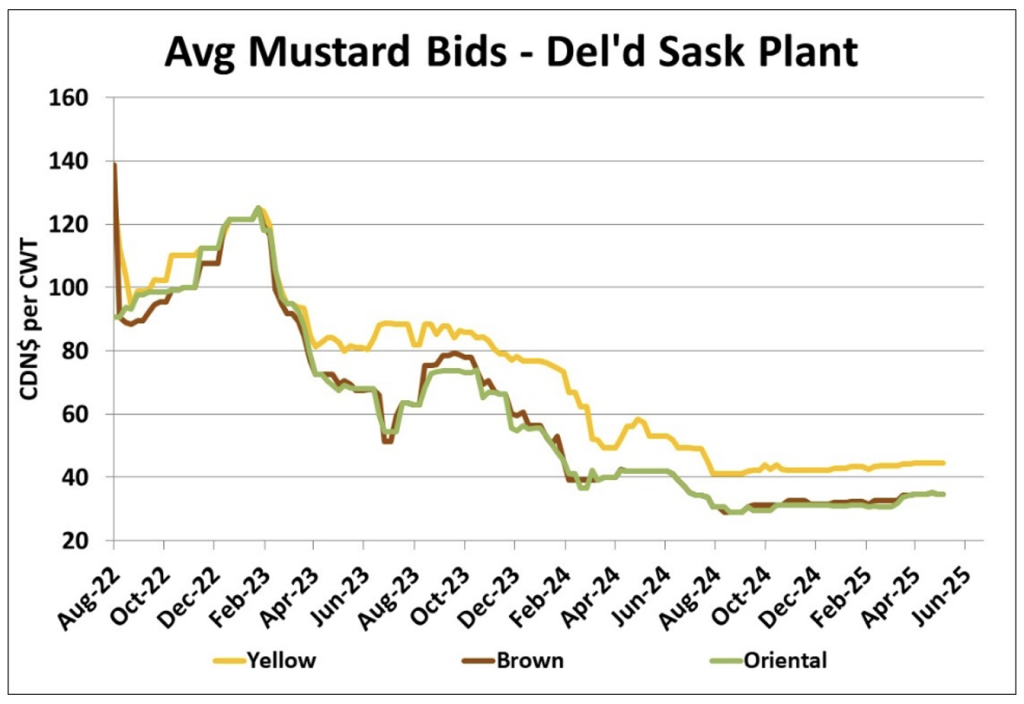

- The seasonal price index for yellow mustard tends to go largely sideways but then drops starting in early July as the market transitions to new-crop price levels. So far in 2025, the average yellow mustard bid has followed that sideways behaviour, with a few weeks left before the normal summer declines. That said, there’s little if any “discount” for new-crop yellow mustard, which suggests that seasonal decline will be modest.

Outlook

Overall, the 2024/25 mustard market has been more stable than we had expected, given the large supplies, but disciplined farmer selling has kept the market steady. The transition from old-crop to new-crop pricing will be quite modest, as long as yields end up close to average. Of course, there are still a lot of questions about 2025 seeded area, which adds to the potential of volatility in either direction, depending how the combination of acres and yields turns out.