Market Developments

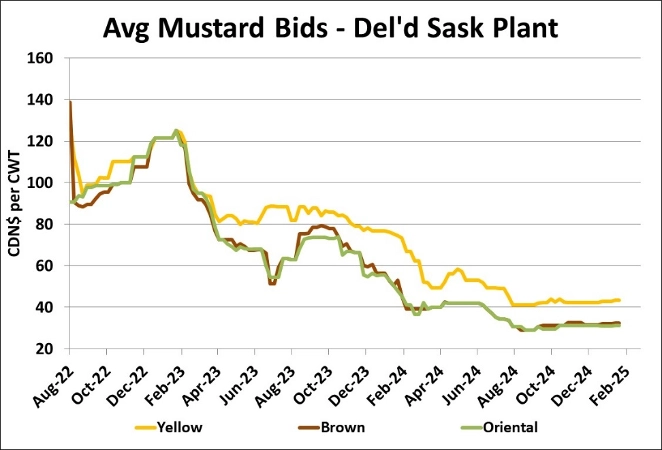

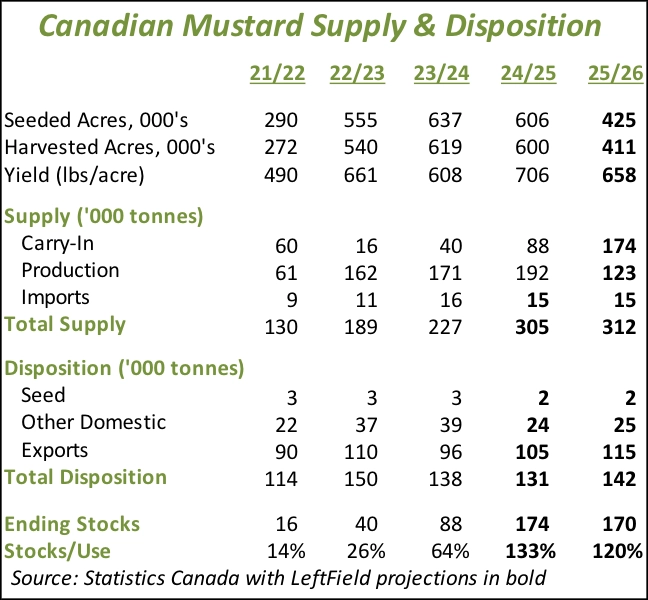

- Despite the weaker price signals, anecdotal reports are suggesting farmers are still interested in planting mustard, especially with disappointing performance of some other crops in 2024. For now, we’re looking at a total of 425,000 acres in 2025, 30% less than last year, although we might be too pessimistic.

- When we look at a possible breakdown by type, we expect brown mustard will show the smallest declines, down roughly 10%, while the relatively small price premium for yellow mustard will cause that class to lose the most acreage, as much as 35-40% lower.

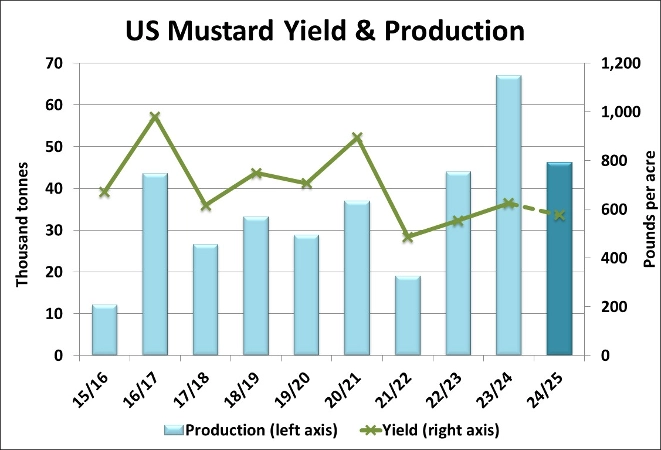

- In its 2024 production report, the USDA pegged the US mustard crop at 102 mln pounds or 46,300 tonnes, 31% less than last year. This was based on a 25% drop in seeded area and a yield of 577 lb/acre, roughly 50 pounds per acre less than last year. This smaller crop is partly offset by a larger old-crop carryover but US domestic supplies are still 19,000 tonnes less than last year. To maintain an average supply level, 2024/25 imports could remain at 120 mln pounds or 54,400 tonnes, similar to 2023/24 but roughly 5,000 tonnes less than the 5-year average.

- Reports from Russia indicate a sharp decline in seeded area of mustard for the 2024 crop, dropping nearly by half (according to one source’s estimate of 2023 seeded area). We haven’t been able to track down yield and production estimates but based on where most of the seeded area was located in the south of the country (where this year’s drought was most severe), yields were almost certainly lower. Even if we pencil in the 5-year average yield of 0.72 tonnes per hectare, 2024 mustard production would be in the range of 135-140,000 tonnes, the smallest since 2020. But as mentioned, the yield could be even lower.

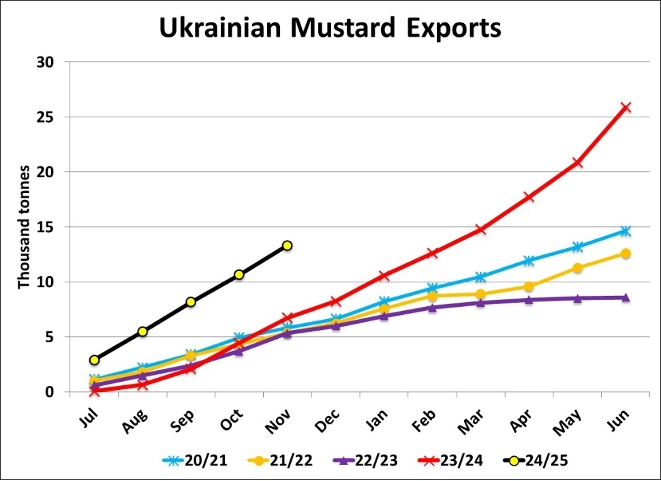

- Ukraine has been a much larger market presence in the EU mustard market in recent months. So far in 2024/25, Ukrainian exports are 13,300 tonnes, the strongest pace since 2016/17. The key question for the outlook is whether Ukrainian supplies are large enough to allow this pace to continue. Our view is that exports will need to slow in the second half of 2024/25, which could increase European demand for Canadian brown mustard in the coming months.

- While there are often questions about the exact supply estimates for Canadian mustard, there’s no question that there’s plenty of mustard out there in 2024/25. While farmers’ reluctance to sell is keeping prices from slipping further, it’s hard to see any prospects of supplies tightening up in 2024/25 and causing prices to rally.

Outlook

The Canadian mustard market continues to move sideways, caught between heavy supplies and the limited selling by farmers. This standoff is expected to continue for the foreseeable future, especially with a weak export market. The large supplies are expected to carry over into 2025/26 and even with reduced acreage, supplies are expected to remain more than adequate. The mustard market often experiences “long lows” and without some sort of supply shock, prices could keep hovering close to current levels over the longer haul.