Market Developments

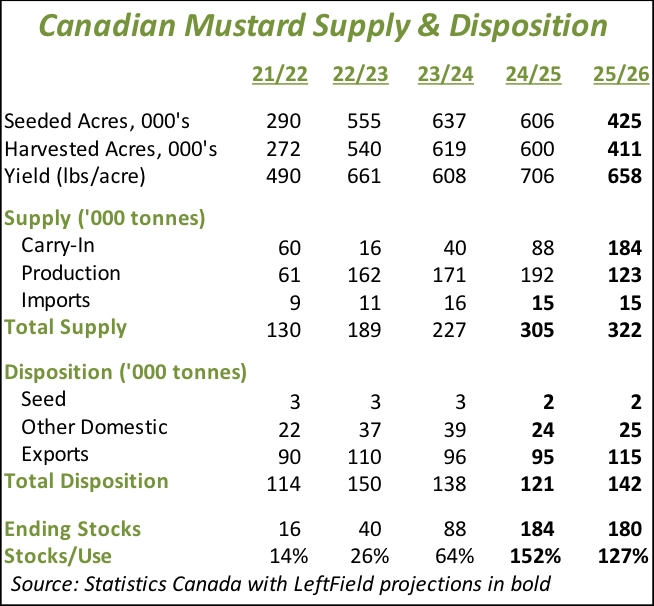

- Based on various feedback, we may have been too pessimistic about 2025 mustard acreage. Earlier, we pegged seeded area at 425,000 acres, 30% less than last year but others are suggesting acres won’t decline much, if at all. It’s still possible yellow mustard would take the largest hit, followed by oriental and brown.

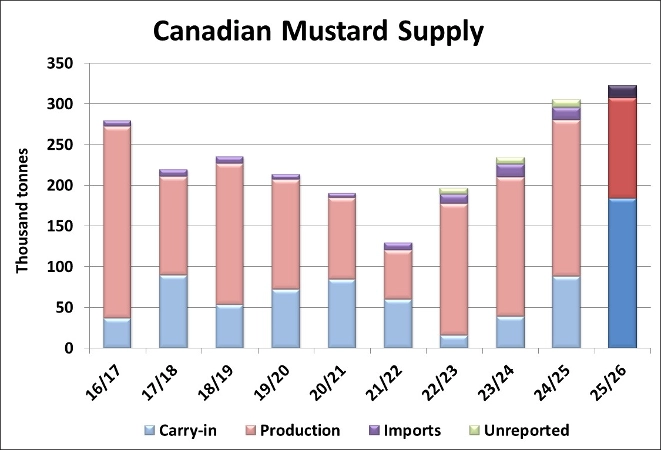

- When we plug in the olympic average yield of 658 lb/acre against this acreage, next year’s crop would drop by nearly 70,000 tonnes (36%) but that still wouldn’t be enough to draw down supplies, which could rise above 320,000 tonnes. And if our initial acreage estimate is too low, next year’s supply situation could become even burdensome and take several years to work its way lower.

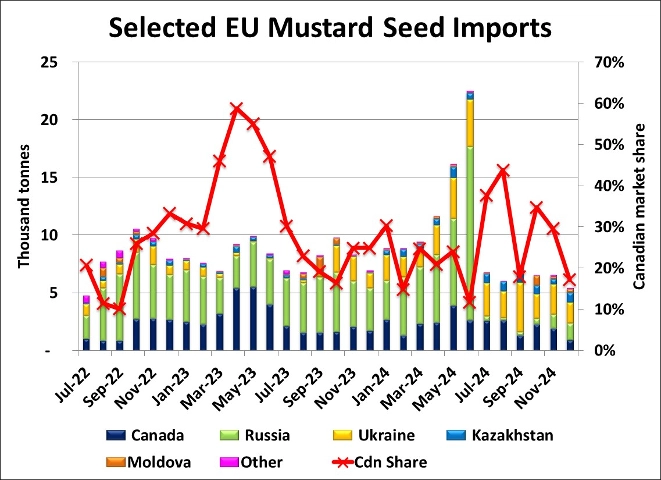

- Mustard imports by the EU slipped to 5,400 tonnes in December, the lowest total since July 2022. Small amounts of Russian mustard are still moving into the EU while Ukraine and Kazakhstan have taken a larger share of the European market. In December, 930 tonnes of Canadian mustard were imported, the smallest amount since August 2022, at the tail end of the 2021/22 drought year when Canadian supplies were next to nil. In 2024/25, low supplies aren’t the issue, which suggests that even at current prices, Canadian brown mustard is not competitive against mustard from other origins.

- Mustard exports by Ukraine continue to run at multiyear highs, although the pace slowed somewhat in December to 1,500 tonnes. Once again, Germany was the largest destination, followed by other western European countries. This brings the year-to-date total to 14,800 tonnes, the strongest pace since 2016/17. Because we don’t have firm estimates of the size of the 2024 Ukrainian mustard crop, it’s difficult to say whether supplies will tighten up and force a sharp slowdown in exports for the second half of 2024/25.

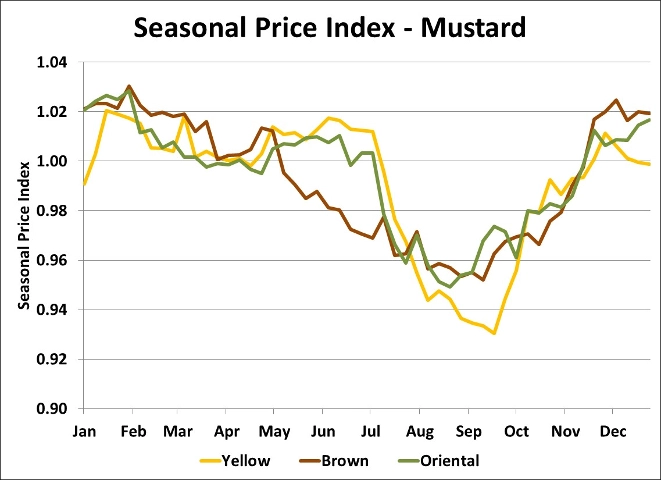

- Seasonal tendencies show that there can be occasional pops in mustard bids in spring, but meaningful rallies don’t tend to occur at this time of year. For both brown and yellow mustard, late April can provide a bit of strength but from there, prices go sideways and eventually lower toward the harvest bottoms. That said, this year’s large mustard supplies will tend to weigh on the market and limit the possible upside that could come from spring export movement.

Outlook

Mustard bids in western Canada are remaining steady in spite of weak demand and large supplies. That said, there’s not much mustard actually being traded and prices are more indications than live bids. New-crop bids are firm but it’s not clear how much mustard is being contracted at these levels. While lack of farmer selling is keeping bids from slipping, the combination of larger supplies and weak exports means a rally is not on the horizon. And if, as some expect, more acres are planted in 2025, the mustard market will remain flat through 2025/26 and beyond.