Market Developments

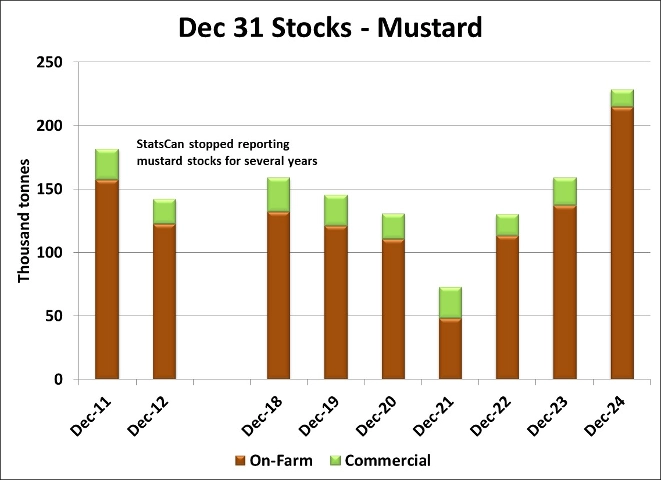

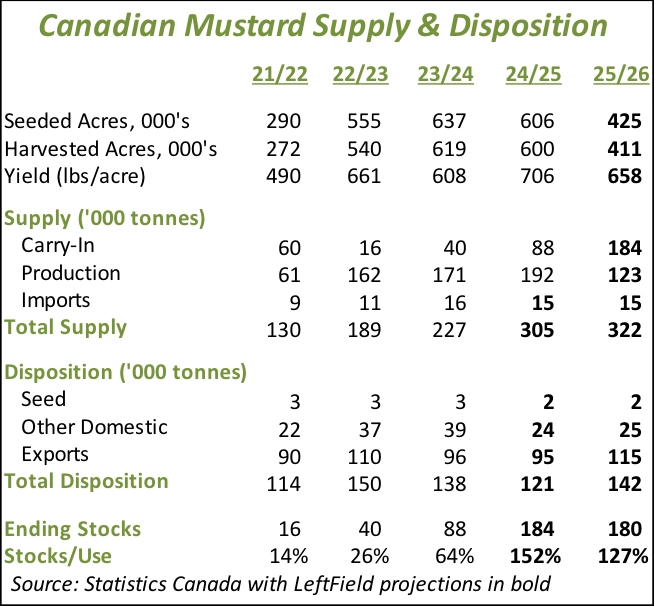

- It was no surprise to see very large Dec 31 mustard inventories reported by StatsCan last week. The 228,000 tonne total is up 69,000 tonnes or 43% from last year and is the most reported since 2005/06. It’s possible farmers have understated mustard inventories to StatsCan, which means the actual stocks would be higher yet. These large stocks, along with the poor export performance, mean the mustard market will be facing headwinds for some time.

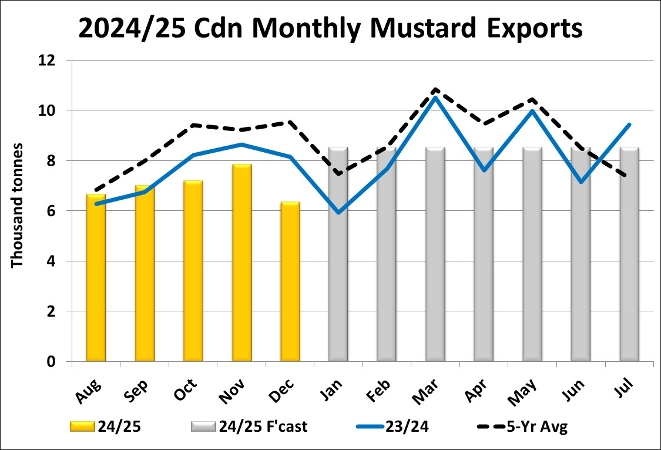

- Canadian mustard exports were already subpar through the first few months of 2024/25 and got even worse in December, at less than 6,400 tonnes. That’s below last year’s modest amount of 8,200 tonnes and well below the 5-year average of 9,500 tonnes. The US was still the largest destination at 3,200 tonnes but that was down 2,000 tonnes from the previous month while December exports to Belgium improved slightly to 1,200 tonnes.

- This even slower pace caused us to cut our full-year export forecast to 95,000 tonnes, roughly 10,000 less than the 5-year average and even this will require a solid recovery in the second half of 2024/25. We’re still looking for improved exports to the EU as Ukrainian supplies dwindle but US tariff prospects are a large unknown in the yellow mustard outlook.

- Mustard imports by the EU in November remained steady at 6,600 tonnes, continuing to be below monthly amounts of 2023/24. Of the total, Ukraine was the largest supplier at 2,600 tonnes followed by Canada at 1,900 tonnes, with volumes still arriving from Russia despite 50% import tariffs. Mustard imports are remaining low, partly due to the large volumes brought in several months ago in advance of the Russian tariffs, but those inventories should soon be returning to more normal levels, with imports expected to pick up somewhat in the next few months. It’s also likely that Ukrainian supplies will start running low soon, unless mustard from Russia is somehow leaking across the border.

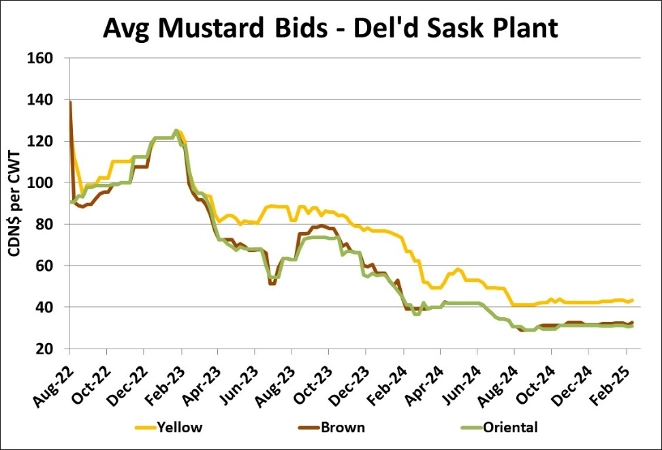

- There’s not much life in mustard markets, with all three classes moving mostly sideways. New-crop yellow mustard is slightly higher in the last week or two but remains below spot prices. It’s difficult to say whether there will be much price movement in the coming weeks, with possible US tariffs as the main unknown in the outlook.

Outlook

Mustard supplies in western Canada are more than comfortable and together with weak export demand, will limit any meaningful upside potential. Meanwhile, farmers’ reluctance to sell at lower than current prices is providing a floor. The possibility of US tariffs is a particular threat to the yellow mustard market, especially for new-crop values, while brown and oriental would be less affected by that risk. Large supplies and soft demand for all classes mean mustard prices will be sideways at best.