Market Developments

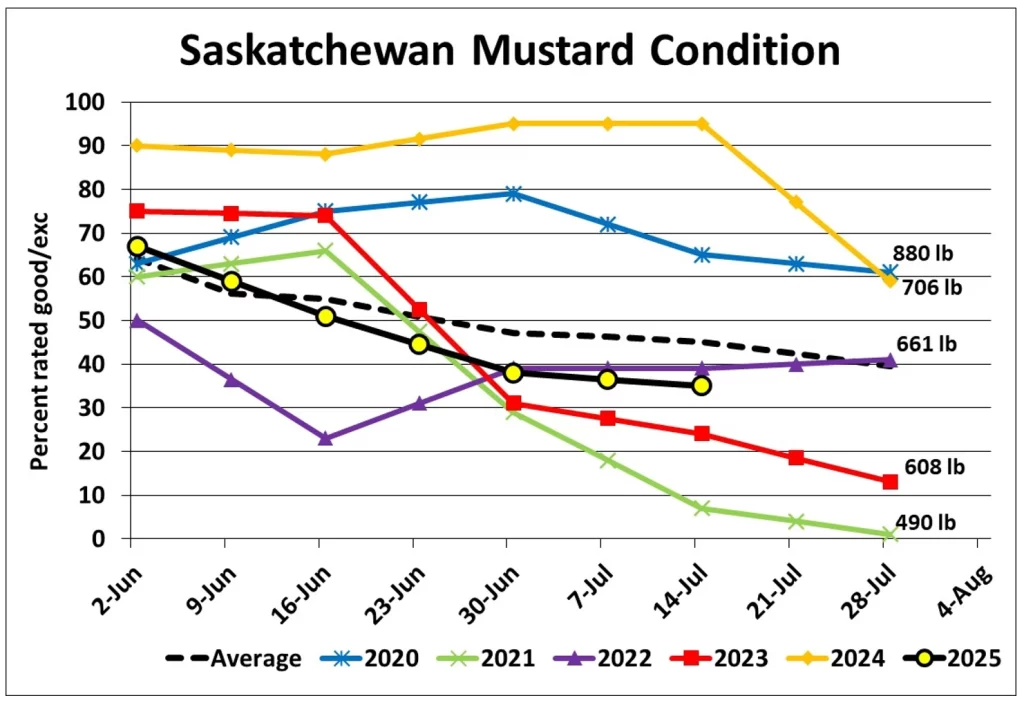

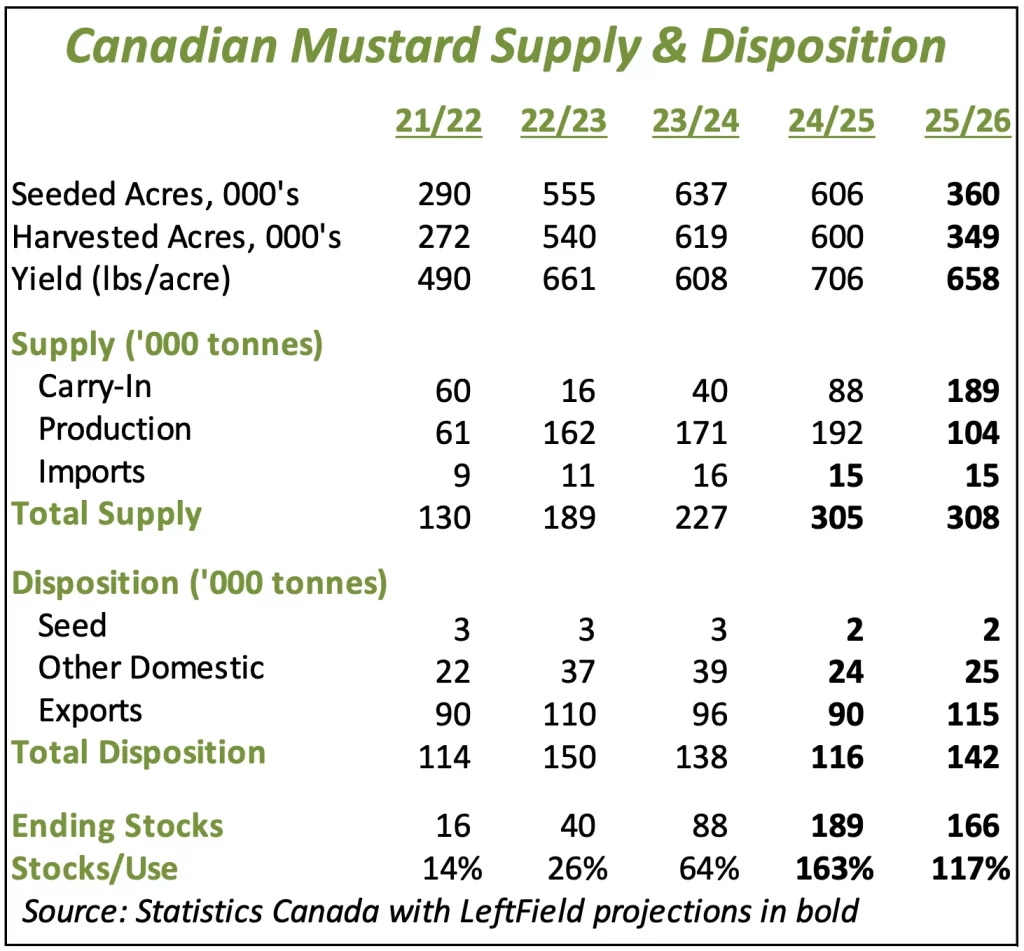

- Based on mid-July crop ratings, we’re still comfortable with using the olympic average yield of 658 pounds (13.2 bushels) per acre for the 2025 mustard crop. This yield is down 7% from last year and together with the 41% acreage decline, would mean a 2025 mustard crop of 104,000 tonnes, 46% less than last year.

- One key question for the Canadian mustard S&D is the quality of the 2024 crop. Supplies in 2024/25 were over 300,000 tonnes and ending stocks are forecast at an extremely heavy 190,000 tonnes. But if, as some reports suggest, a large part of those supplies are low quality, it’s not a clear picture of actual supplies available for export or domestic processing. Even with a much smaller 2025 crop, mustard supplies (on paper) appear very large again for 2025/26, but that bearish picture could be overstated.

- Saskatchewan mustard crop ratings from the past few years show final ratings and yield are correlated, but the direction late in the season is also important. For example, in 2024, ratings were exceptionally high for much of the season but dropped off sharply and pulled the yield down considerably. In 2025, mustard crop ratings have been declining throughout the season (which is fairly typical) and as of July 14, were at 35% good/exc, compared to the 10-year average of 45%. More recent rains in southern Saskatchewan may have helped stabilize late-season ratings, suggesting a yield close to 2022 is a reasonable guesstimate.

- This week, the USDA’s crop ratings for the Montana mustard crop turned higher, from 5% good/exc to 22% good/exc. This suggests recent rains have provided some relief but it’s getting late for a meaningful change in crop prospects. Montana mustard yields have been depressed for several years and the average is already low. Our latest yield estimate is 525 lb/acre, 10% less than the average but still better than 2021, when the yield was 486 lb/acre. Based on the USDA’s acreage, this would mean a crop of 80 mln pounds but we also expect some area will not be taken to harvest, putting our US production forecast at 72 mln pounds, 30% less than last year.

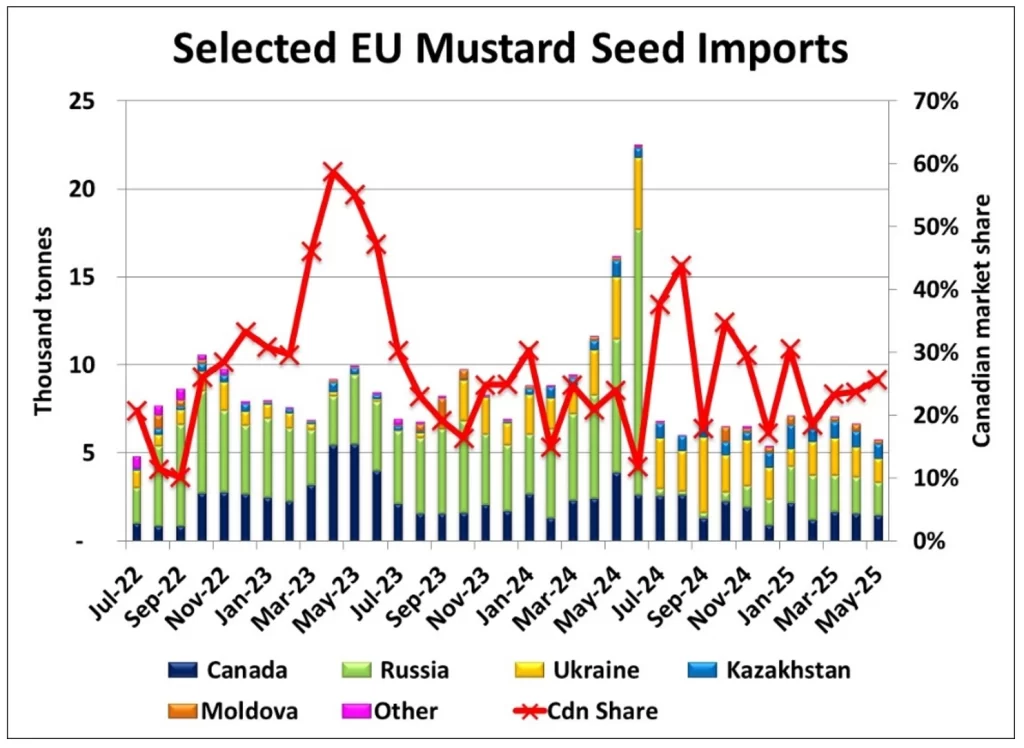

- There’s still no sign of a recovery in EU mustard imports, with the May total slipping to 5,800 tonnes. Despite 50% import tariffs, Russia was again the largest source at 1,800 tonnes with Canada providing 1,500 tonnes and Ukraine at 1,400 tonnes. We don’t have solid estimates of 2025 Black Sea mustard production, but anecdotal reports suggest Ukrainian and Russian farmers planted more of the crop. There’s no certainty with respect to yields, but we would expect fresh Ukrainian supplies will start arriving in western Europe in the Sep/Oct. At the same time, Russian mustard, heavily discounted to offset the tariff, will also be available.

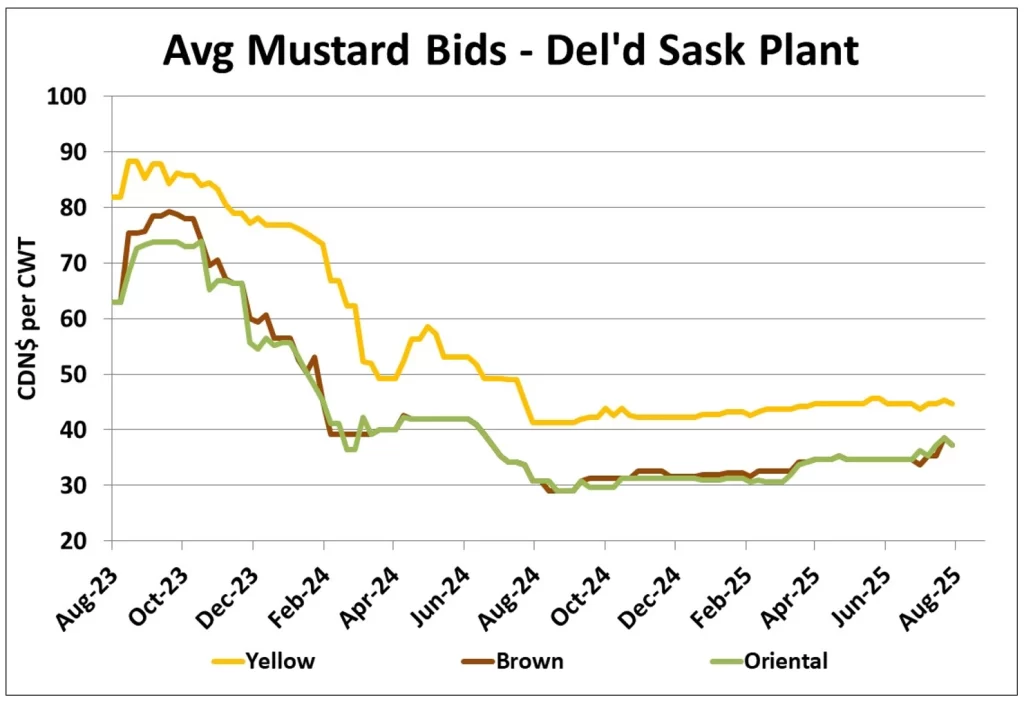

- The western Canadian mustard market has been flat for most of 2024/25, but bids are starting to show some signs of life, with the average brown mustard bid a bit more responsive. Oriental bids have also edged higher while yellow bids are still largely unchanged. The moves still aren’t large but seem to reflect concerns about the size of the 2025 crop. Lack of farmer selling is also seen as a supportive factor.

Outlook

While recent rains in the southern prairies may have stabilized or even improved the mustard crop outlook, 2025 production will still be reduced. The supply picture is still quite cloudy, due to questions about the quality of the carryover from 2024/25. This will keep mustard bids on edge and could allow some modest gains. That said, the biggest hurdle for the 2025/26 mustard outlook is the disappointing demand. Competition from Black Sea mustard will continue to limit upside price potential.