Market Developments

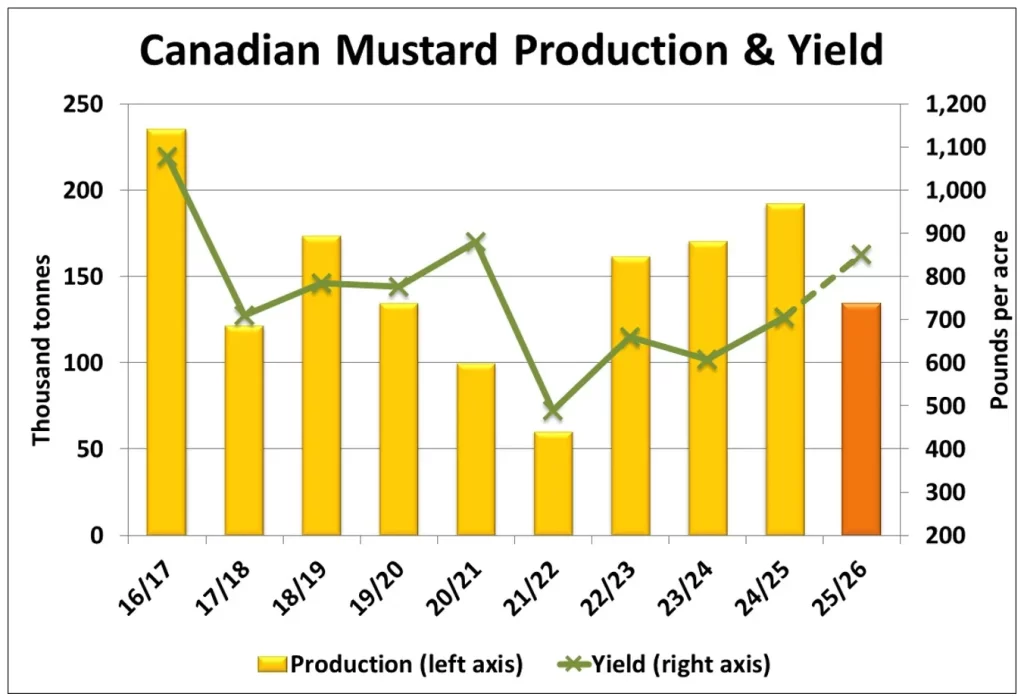

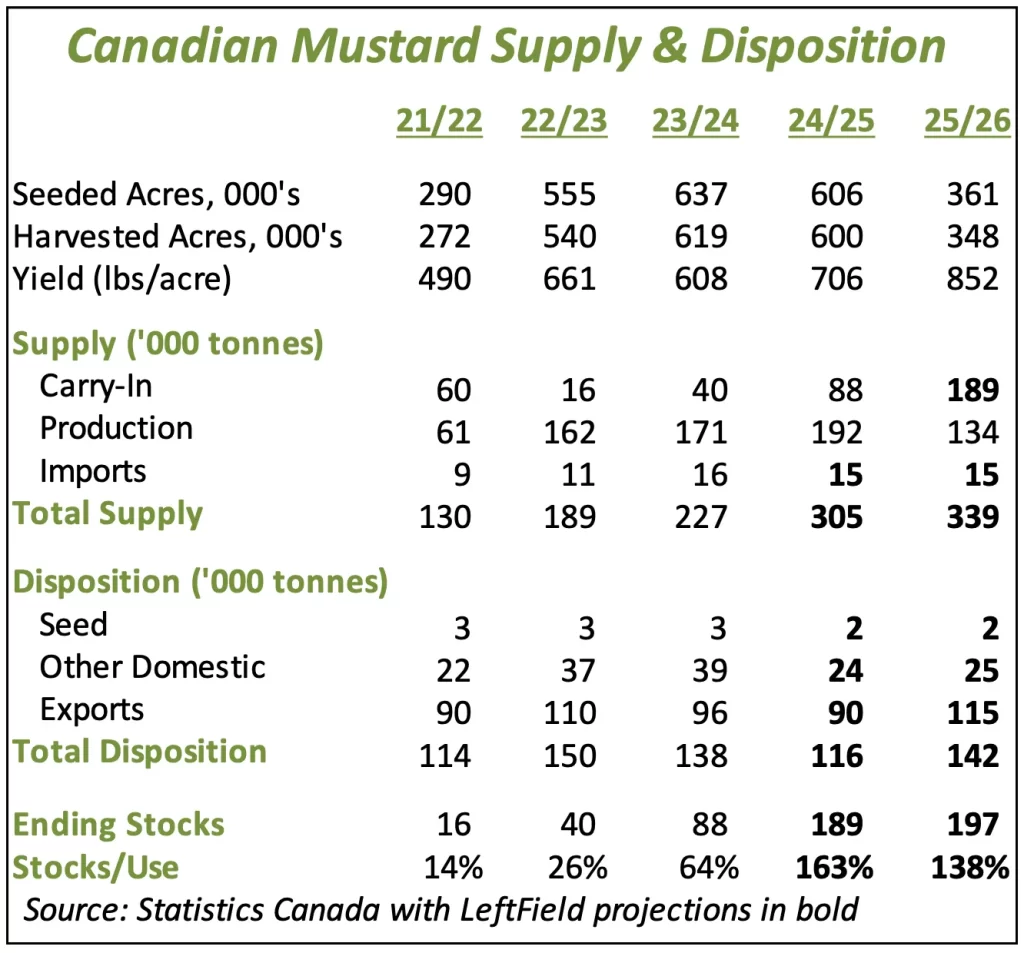

- StatsCan’s first model-based yield estimate came in this week at 134,000 tonnes, 30% less than last year, partly offsetting the 40% drop in acreage. The yield was reported at 852 lb/acre, the strongest yield since 2020/21, which fits with initial harvest reports.

- Despite the smaller crop, this StatsCan estimate would mean 2025/26 supplies would be 30,000 tonnes larger than the current year. Keep in mind, there are still questions about the quality of the sizable old-crop carryover.

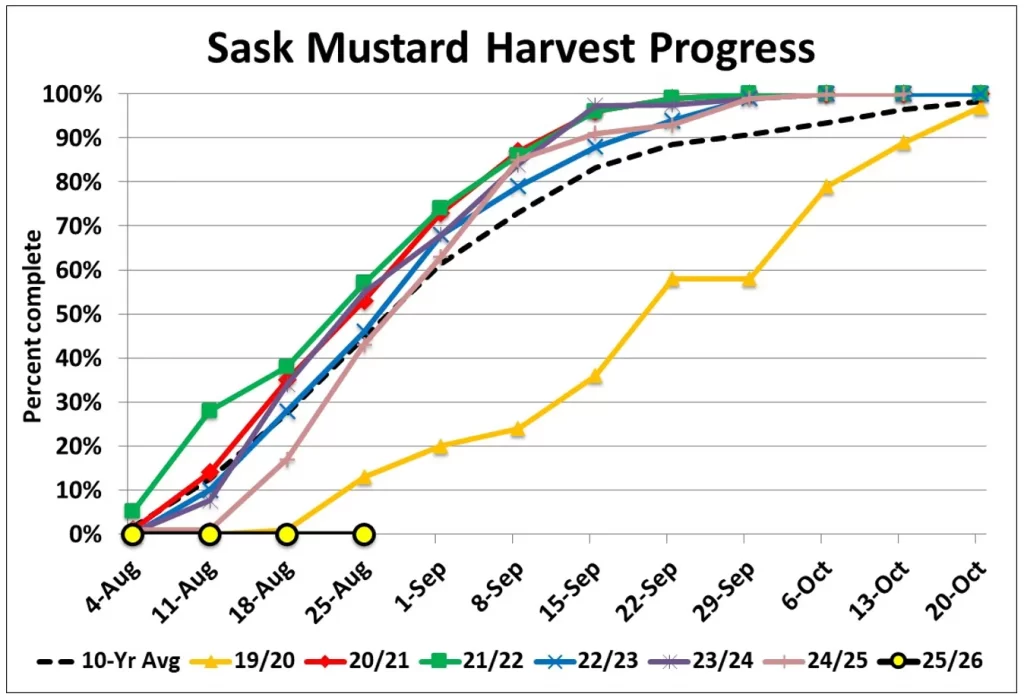

- We expect there’s been some progress in the mustard harvest in the past week, but as of the last Sask Ag crop report, nothing had occurred yet as of August 25. That’s far below the 10-year average of 45% complete and is even slower than the very poor start of 2019/20. Compared to pulse crops, the delays won’t have caused as much damage to mustard quality. Since the Sask Ag crop report, conditions have improved and the weather forecasts for the coming week are quite favourable, which should allow some catch-up in harvest progress.

- Mustard imports by the EU improved to 9,400 tonnes in June, the highest total since a year ago, when imports spiked to avoid the tariffs on Russian mustard. Even with the tariffs though, Russia was the largest origin in June at 2,700 tonnes, just edging out Canada, while Ukraine and Kazakhstan were also sizable suppliers. In fact, the 1,700 tonnes from Kazakhstan were the most from that country since July 2019.

- For the full 2024/25 marketing year, EU mustard imports were 81,800 tonnes, well below a year ago (which was distorted by the Russian tariff situation) but also lower than the 5-year average of 101,000 tonnes. We expect strong competition in the EU market again for 2025/26, especially from Ukraine and Kazakhstan as larger crops were grown this year.

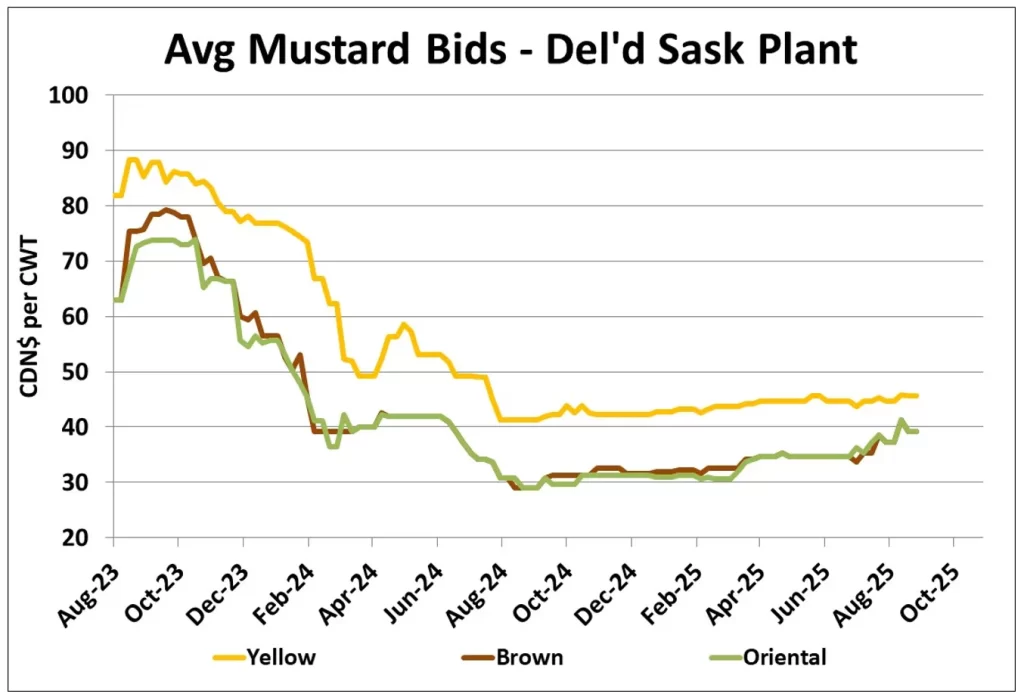

- Bids for brown and oriental mustard have been firming up through the spring and summer months, helped by reluctant farmer selling and concerns about the quality of remaining stocks. At the same time, yellow mustard bids largely moved sideways for much of 2025. In the last week or two though, prices for all classes have dipped as the harvest approaches and better-than-expected yields are coming into view. This move can be seen as a bit of harvest pressure and may not last all that long, but that largely depends on how much yields have improved in 2025.

Outlook

The Canadian mustard market remained firm through 2024/25, due to questions about old-crop supplies. This year’s reduced acreage means that strength has carried forward into 2025/26. We haven’t seen too many harvest results yet but would expect mustard is performing well, just like most other crops. Improved yields will partly offset the lower acreage but supplies of (quality) mustard won’t be heavy. At the same time though, Canadian mustard will face more export competition in Europe and elsewhere, limiting the upside potential for prices.