Market Developments

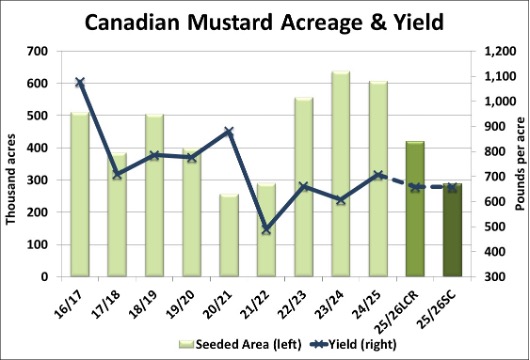

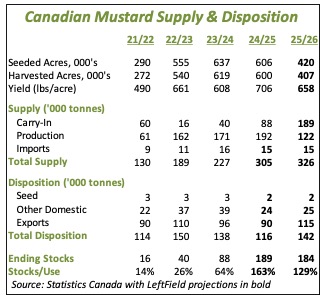

- We’re still skeptical about StatsCan’s estimate of a 52% drop in mustard acreage for 2025, but we have trimmed our guesstimate somewhat, based on various feedback. For now, we’re looking at 420,000 acres, 31% less than last year. We expect a larger percentage decline will show up in yellow mustard, but all three classes will be lower than last year. If we apply the overall olympic average yield of 658 lb/acre, the 2025/26 crop would come in at 122,000 tonnes, 37% less than last year.

- Plugging in the average yields for each of the three classes would mean a 47% drop in the yellow mustard crop while brown and oriental would be down 19% and 23% respectively. Of course, seeding is still in its early stages and it’s far too early to estimate yields, but initial conditions are generally favourable in key growing areas.

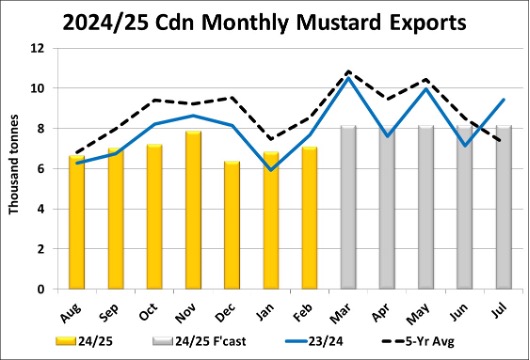

- Canadian mustard exports edged slightly higher in February to 7,100 tonnes, although that’s still below year-ago levels of 7,700 tonnes and behind the 5-year average of 8,500 tonnes. The US was the dominant destination again at 4,100 tonnes followed by Belgium at 1,400 tonnes. We’ve been waiting for some improvement in export volumes and while a seasonal increase is still possible, we’ve trimmed our full-year export forecast to 90,000 tonnes, compared to last year at 96,000 tonnes and the 5-year average of 104,000 tonnes. This reduction adds to 2024/25 ending stocks, now even more burdensome at 189,000 tonnes.

- Mustard imports by the EU remain subdued, with the February total just over 6,700 tonnes, well below year ago levels of 8,900 tonnes and less than the 5-year average of 7,700 tonnes. Even with 50% tariffs, Russian mustard is still finding its way into the EU and in February, was the largest origin at 2,500 tonnes. After rising in January, imports from Canada slipped back to only 1,200 tonnes in February and while a larger spring shipment is possible through Thunder Bay, there isn’t any mustard movement showing up in the CGC weekly data.

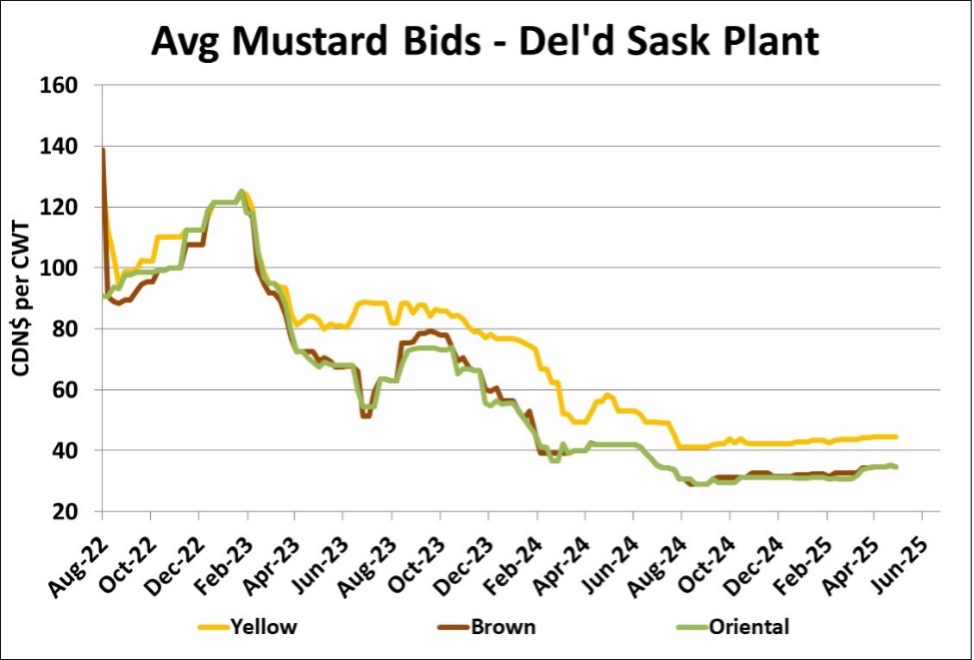

- Earlier in this calendar year, there had been some upward movement in mustard bids, including new-crop prices. In the last few weeks though, those bids have flattened out again with trade being quite inactive. At this point in the marketing year, seasonal price patterns are sideways over the next few weeks for yellow and oriental mustard, while the brown mustard index already tends to decline.

Outlook

There’s very little activity in the Canadian mustard market. Export volumes are still quieter than usual, which allows buyers to remain on the sidelines. At the same time, farmers are unwilling to sell old-crop inventories, and this standoff is keeping prices unchanged. The main source of support is the idea that 2025 acreage will be down sharply and will eventually solve the large supply situation. We’re not quite convinced that seeded area will drop as much as StatsCan has said which, together with weather developments, adds more uncertainty to the new-crop price outlook.