Market Developments

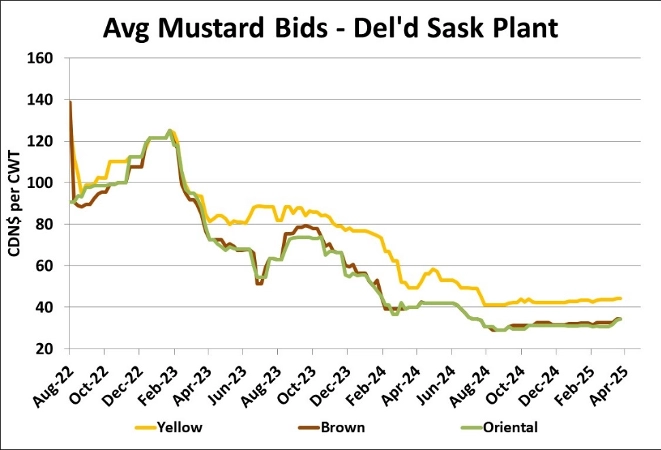

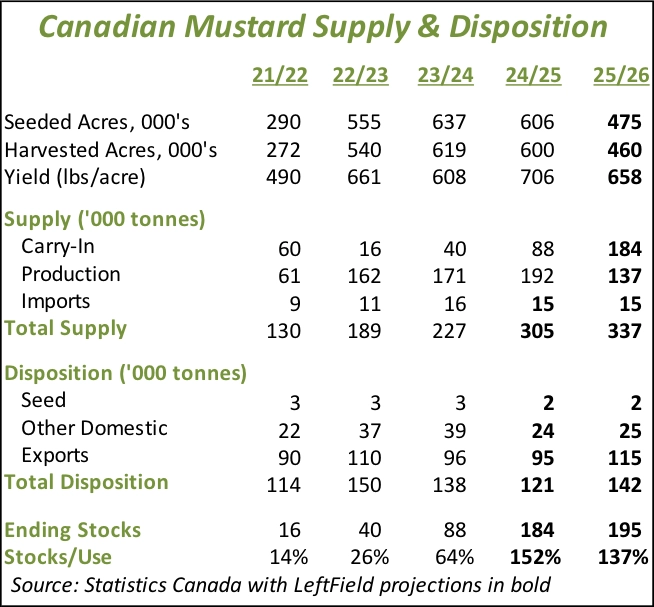

- On the surface, Canadian mustard supplies appear very heavy and are set to remain that way into 2025/26. That said, the steady or even slightly improving bids are raising some doubts. One possibility is that StatsCan overestimated mustard yields in 2024. The yield data from Saskatchewan Crop Insurance (SCIC) shows a 2024 yield of only 568 lb/acre versus StatsCan at 739 lb/acre, a wider-than-usual difference between the two sources. It could also be that on-farm mustard supplies exist but aren’t really available, as the only way to encourage selling is by raising bids. Another possible issue we’ve heard is that some mustard supplies from 2024 include an admix of canola but there’s no way to know the scale of that problem. There’s a good chance it could be a combination of all three issues that have resulted in a “disconnect” between supply numbers and prices.

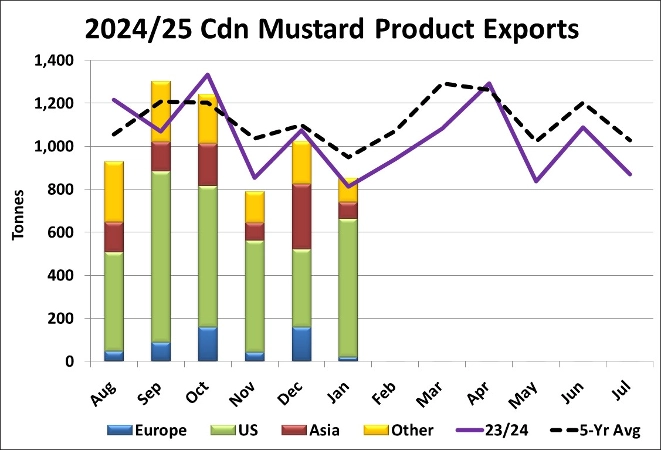

- In January, Canadian exports of mustard products (HS code: 210330, mustard flour and meal and prepared mustard) dropped back to 850 tonnes. Very little was shipped to Europe and the larger volumes to Asia in December faded again in January. That said, exports to the US were somewhat larger. This is the third straight month however that exports have been low average and after a stronger Q1, this year’s year-to-date pace of 6,100 tonnes is slipping further behind the 5-year average of 6,500 tonnes. The high point in the year tends to be Mar/Apr and we hope that can occur without US tariff complications.

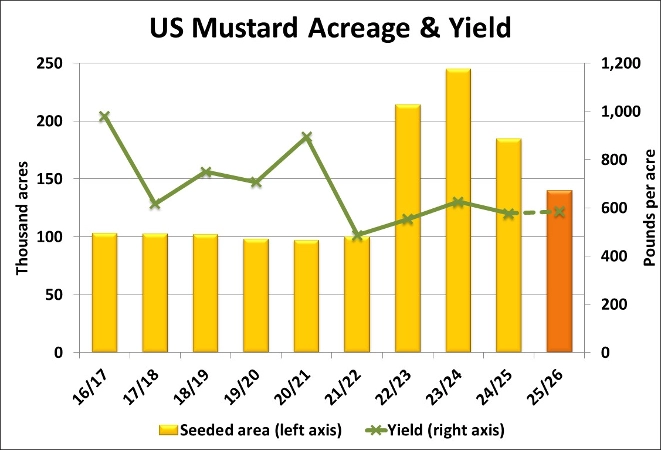

- The USDA doesn’t issue an estimate of mustard acreage in its Prospective Plantings report, but we’re expecting to see another decline this year. Our guesstimate for 2025 US seeded area is 140,000 acres, 24% less than last year. This would continue the decline from the 2023 high point but still wouldn’t drop back to the pre-2022 acreage levels. If the 2025 mustard yield would end up at the olympic average yield of 585 lb/acre, production would drop to 75.2 mln pounds or 34,100 tonnes, 27% less than last year. Under this scenario, US mustard imports would actually need to rise to maintain steady supplies in 2025/26. If so, that could mean the importers in the US would need to absorb some of the cost of tariffs.

- Mustard imports by the EU recovered in January to 7,200 tonnes, the largest total since September 2024 but still below a year ago at 8,900 tonnes. Imports from Canada bounced back at 2,200 tonnes, with Russian mustard still finding its way into the EU, despite 50% tariffs. Volumes from Ukraine continue to decline, due to its dwindling supplies caused by larger exports earlier. Imports from Kazakhstan were higher at 1,300 tonnes, the most since 2019. The year-to-date pace of imports (since July 2024) is still weak at 46,100 tonnes, compared to the 5-year average of 55,800 tonnes. This could mean that imports will need to pick up in the next few months, which could benefit export movement from Canada.

Outlook

Whether it’s because farmers are digging in their heels and not selling or because supplies of quality mustard aren’t actually available (or a bit of both), bids are moving higher. Lagging exports in 2024/25 remain a large obstacle for the mustard market. Higher prices will tend to discourage demand and limit the “rally”. While the low 2025 acreage number from StatsCan may have raised some eyebrows, other feedback is indicating seeded area won’t drop too far. And with average yields, that will keep a lid on the 2025/26 market.