Market Developments

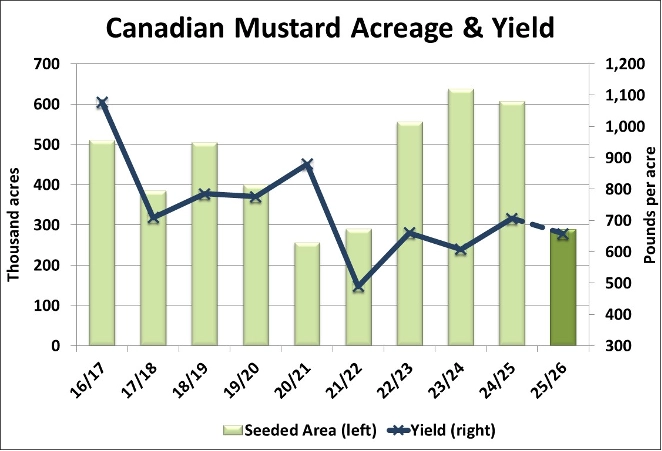

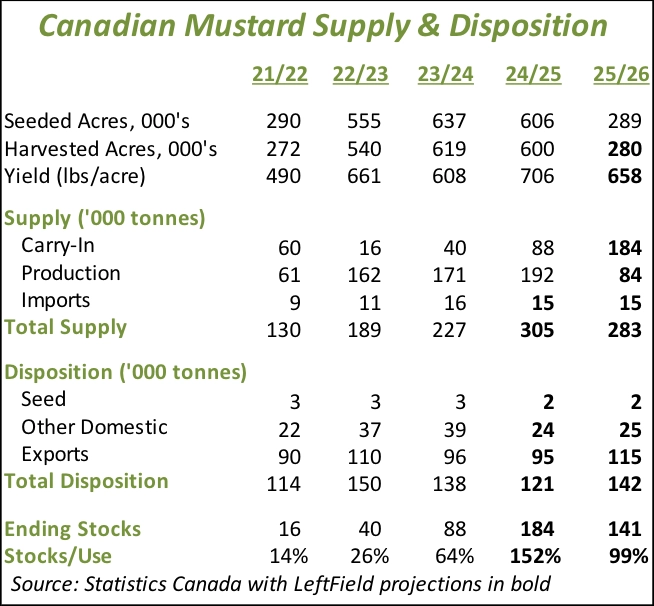

- Last week, StatsCan issued its 2025 seeding intentions estimate for mustard at 289,000 acres, a 52% drop from 2024 and back down to levels seen in 2021/22. Our own guesstimate was for a more modest 22% decline in seeded area at 475,000 acres. There’s always uncertainty in seeded acreage of a crop like mustard, but based on other feedback we’ve been getting, it seems StatsCan’s estimate is too low. It wouldn’t be unusual for farmers to underreport mustard acreage to StatsCan, and that could be a factor in its very low number.

- A sharp drop in acreage would be very helpful for reducing the heavy supplies that have built up in the last year or two. Even so, if acres came in at StatsCan’s estimate with the olympic average yield of 658 lb/acre, production would drop by more than half, but 2025/26 supplies would still be large at 280-290,000 tonnes.

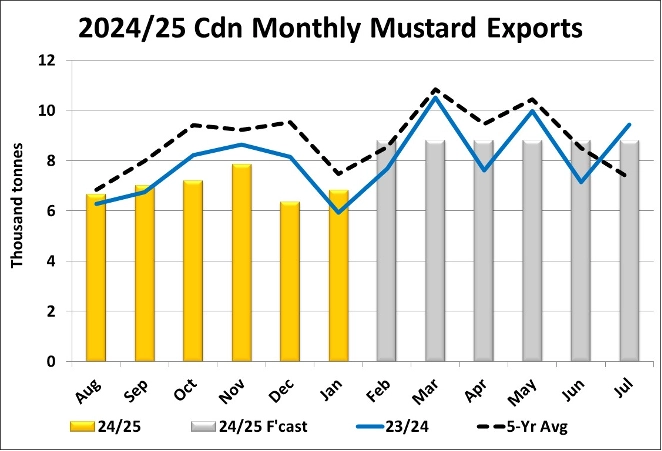

- Canadian mustard exports improved slightly in January to 6,800 tonnes and were a bit above last year’s low point, but this was still well below the 5-year average of 7,500 tonnes. Other than exports to the US of 3,500 tonnes, no other country took more than 1,000 tonnes. The year-to-date pace of exports is 42,000 tonnes, trailing last year slightly and well behind the 5-year average pace of 50,500 tonnes. This means the prospects of reaching our full-year export forecast of 95,000 tonnes seem to be dimming. That said, the second half of 2023/24 was better than the first half and a similar pattern is possible for 2024/25. For now, we’ll leave our target unchanged, but a noticeable improvement will be needed soon.

- Mustard imports by the US so far in 2024/25 are 32,500 tonnes, trailing last year’s below-average pace of 36,700 tonnes and the gap appears to be widening. Imports are reduced despite a 31% drop in 2024 US mustard production and seem to signal larger-than-reported US supplies. It also helps that US exports of 13,700 tonnes so far in 2024/25 are well behind last year’s strong pace of 21,900 tonnes, which keeps more mustard within its borders. There’s a good chance US farmers will also be cutting mustard plantings in 2025, which will help keep a lid on North American supplies. Of course, the potential for US tariffs remains a large concern for the Canadian trade, especially in 2025/26.

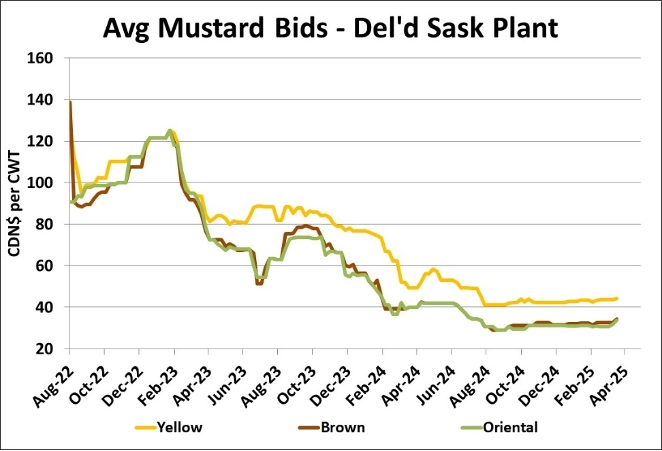

- Mustard bids are showing that there is some life in the market, likely signaling some improved export movement ahead which requires firmer bids to convince farmers to open their bins. Both old-crop and new-crop bids are rising to attract more selling or forward-contracting. Seasonal charts show some potential for improved prices in the short-term, prior to the normal seasonal declines that occur through the summer months.

Outlook

Mustard exports have been disappointing through the first half of 2024/25 but firming bids suggest some improvement is ahead. Disciplined farmer selling has been able to provide support for prices. The underlying heavy supplies are still out there though, but just aren’t available to buyers at current prices. While stronger prices are positive, we remain cautious that upside will be capped as soon as farmers start selling again. We’re also skeptical that 2025 seeded area will drop as much as reported by StatsCan, and that will keep supplies heavy.