Market Developments

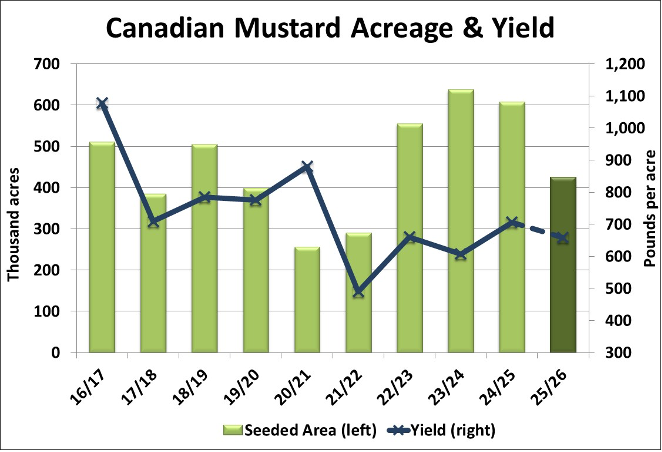

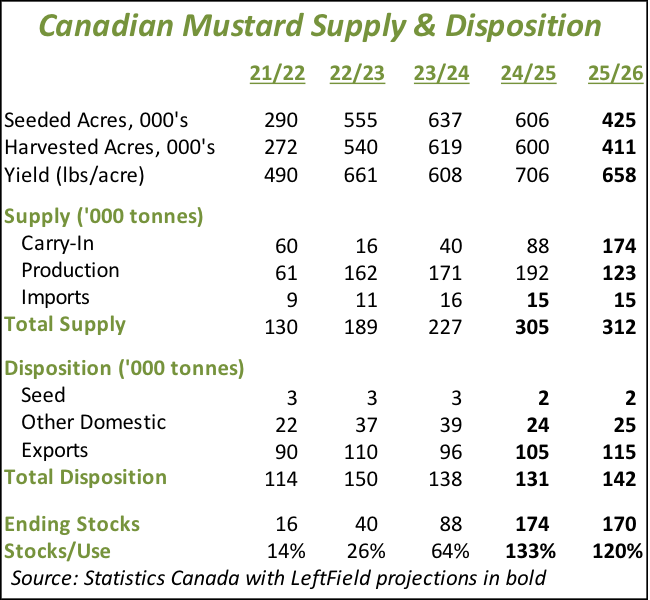

- Our guesstimate of 2025 mustard seeded area is 425,000 acres, down 30% from last year and the lowest since 2021/22. That said, even though mustard bids are down considerably from the last few years, we might be too pessimistic. Gross margin comparisons don’t look too bad for mustard and we’ve heard of farmers in the brown soil zone still looking at mustard favourably, especially after the last few years of poor canola yields. On the other hand, farmers are sitting on large inventories of mustard with very slow export movement.

- If we pencil in this acreage drop with the olympic average yield of 658 lb/acre, 2025 production would be down 70,000 tonnes from last year. That said, it looks like old-crop carryover from 2024/25 will be 85,000 tonnes more than the previous year, meaning that 2025/26 supplies could end up even larger than the current year. Under this scenario, it will take a few years for supplies to drop back to more normal levels.

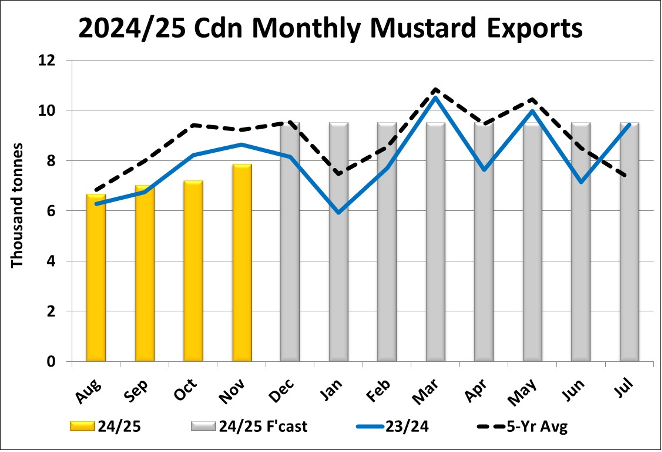

- Canadian exports of mustard seed improved a bit in November to 7,900 tonnes, with increased volumes going to the US but less to Europe. Exports continue to lag well behind the average and are even trailing last year’s lacklustre pace. Through the first four months, Canada has exported 28,800 tonnes of mustard, the slowest start since 2002/03. For now, we’re keeping our full-year forecast at 105,000 tonnes, which would require a monthly average of 9,500 tonnes, but that’s looking increasingly out of reach. There are still some possibilities of improved demand to Europe later in 2024/25 but that may not be enough to overcome the backlog.

- Mustard imports by the EU were modest again in October at 6,600 tonnes, with Canada as the largest source at 2,300 tonnes. Some mustard is coming in from Russia despite the tariffs, but the amounts are quite small. This slow pace isn’t a surprise, given the extremely large supplies brought in prior to the tariffs on July 1. At some point in the next few months though, the buildup in inventories will be drawn down and if availability from Ukraine is limited, more Canadian mustard will be needed later in 2024/25.

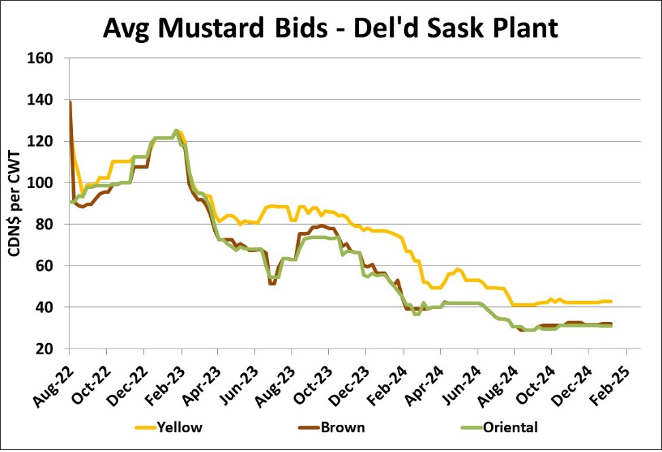

- There hasn’t been much activity in mustard markets in the last few weeks. Yellow mustard bids did bump up earlier as US tariffs threats spurred a bit more business. Meanwhile the average new-crop yellow mustard bid dipped slightly, but that was mainly because more buyers are starting to issue bids. Both brown and oriental mustard bids aren’t showing any movement with very little activity going on at those price levels.

Outlook

Mustard markets are currently very quiet. Bids are running sideways, with farmers not interested in selling while buyers are also sitting back now that their needs are covered. As such, prices are mostly indications and not really active. Exact supply levels are tricky to nail down, but there’s plenty of mustard out there and it’s more a matter of the price at which farmers would respond. Perhaps more concerning is the lack of export demand, even with prices at multiyear lows. This situation sets the stage for long-term sideways direction.